Insurance

Description of the insurance markets on which PZU Group companies operate

Non-life insurance market in Poland

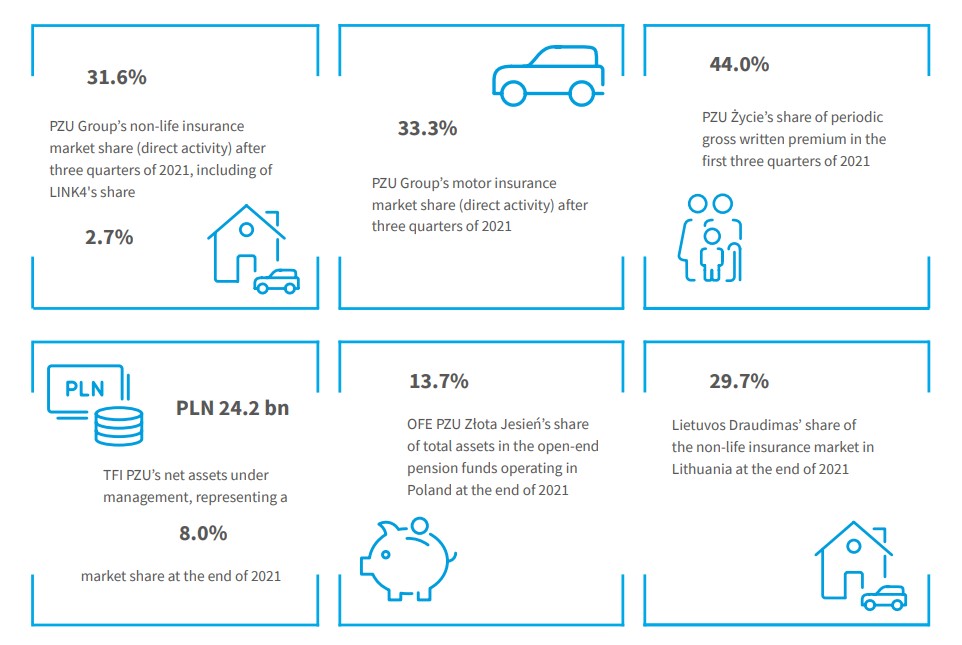

Measured by gross written premium in the first three quarters of 2021, the non-life insurance market in Poland grew by a total of PLN 3.2 billion (+10.4%) in comparison to the corresponding period of the previous year.

The market growth was driven primarily by gross written premium increase in the non-motor insurance area by PLN 2.3 billion (+17.7% y/y), while gross written premium in the motor insurance area was PLN 1.0 billion higher (+5.2% y/y).

Gross written premium of non-life insurers in Poland (in PLN milion)

Source: KNF’s Quarterly Bulletin (www.knf.gov.pl), Rynek ubezpieczeń [Insurance market] 3/2021, Rynek ubezpieczeń 3/2020, Rynek ubezpieczeń 3/2019, Rynek ubezpieczeń 3/2018, Rynek ubezpieczeń 3/2017

In motor insurance the gross written premium in motor TPL insurance, which is the most important category for the overall market, (PLN 12.0 billion representing 35.0% of the overall premium in non-life in the first three quarters of 2021) increased by PLN 268 million y/y (+2.3% y/y). For the first time in three years, gross written premium increased in direct business (up PLN 261 million, +2.4% y/y) and in two years in indirect business (PLN 6.4 million, +0.8% y/y). The change of the trend was caused by a gradual recovery of the leasing market to the pre-pandemic financing levels, higher sales among dealers and lower price activity of competitors due to the deteriorating profitability of the portfolio (partial return to the pre-pandemic claims frequency and higher claims handling costs). The sales of motor own damage insurance rose by PLN 683 million (+10.6% y/y) up to PLN 7.1 billion, which accounted for 20.7% of the overall written premium in non-life insurance in the first three quarters of 2021.

In non-motor insurance, the increase in gross written premium was affected mostly by higher sales of insurance against fire and other damage to property (up PLN 1.1 billion, or 17.6% y/y, of which PLN 390 million was for indirect activity), accident and illness insurance (up PLN 437 million, +21.8% y/y) and insurance against various financial risks (up PLN 356 million, +52.8% y/y). A decline was observed in legal assistance products only (down PLN 3 million, -4.5% y/y).

In the first three quarters of 2021, the overall non-life insurance market generated a net result of PLN 3,851 million, which is PLN 813 million more in comparison with the corresponding period of 2020. Excluding the dividend from PZU Życie, net profit of the non-life insurance market increased by PLN 930 million (+54.5% y/y).

Non-life insurers – percentage of gross written premium in the first three quarters of 2021 (in %)

Groups: Allianz – Allianz, Euler Hermes, Aviva, Santander Aviva TU S.A.; Ergo Hestia – Ergo Hestia; Talanx – Warta, Europa; VIG – Compensa, Inter-Risk, Wiener, TUW TUW; Generali Group - Generali, Concordia

* PZU Group – PZU, LINK4, TUW PZUW; including PZU Group’s market share in non-life insurance on direct business

** 9 April 2021 - KRS registration of the merger of AXA UBEZPIECZENIA TUiR S.A. (surviving company) and UNIQA TU S.A. (acquired company), effected by transferring all assets of UNIQA TU S.A. to AXA UBEZPIECZENIA TUiR S.A. and changing the name of the surviving company from AXA UBEZPIECZENIA TUiR S.A. to UNIQA TU S.A. On 9 April 2021, the acquired company terminated its activity

Source: KNF’s Quarterly Bulletin. Rynek ubezpieczeń [Insurance Market] 3/2021

After the first 3 quarters of 2021, the technical result of the non-life insurance market fell by PLN 109 million to PLN 2,253 million. This was driven mainly by a decrease in the technical result in motor own damage products by PLN 203 million (effect of an increase in loss ratio on the portfolio), in assistance products by PLN 66 million, while the result on loan and guarantee insurance increased by PLN 145 million and on insurance against fire and other damage to property increased by PLN 40 million y/y.

After three quarters of 2021, the PZU Group had a 31.9% share in the non-life insurance market (31.6% on direct sales) compared with 32.6% in the corresponding period of 2020 (32.1% from direct business). With a slight decrease, it maintained high portfolio profitability.

After the first three quarters of 2021, the PZU Group’s technical result (PZU together with LINK4 and TUW PZUW) stated as a percentage of the overall market’s technical result was 42.5% (the PZU Group’s technical result was PLN 957 million while the overall market’s technical result was PLN 2,253 million).

The total value of the investments made by non-life insurers at the end of Q3 2021 (net of the investments made by subordinated entities) was PLN 72,847 million, up 3.2% compared to the end of 2020.

Non-life insurers estimated their net technical provisions at an aggregate amount of PLN 61,615 million, signifying a 4.8% growth compared to the end of 2020.

Non-life insurance market – gross written premium vs. technical result (in PLN million)

| Gross written premium vs. technical result | 1 January - 30 September 2020 | 1 January - 30 September 2021 | ||||

| PZU* | Market | Market net of PZU | PZU* | Market | Market net of PZU | |

| Gross written premium | 10 131 | 31 112 | 20 981 | 10 969 | 34 351 | 23 382 |

| Technical result | 1 077 | 2 362 | 1 285 | 957 | 2 253 | 1 297 |

Source: KNF’s Quarterly Bulletin (www.knf.gov.pl). Rynek ubezpieczeń 3/2021, PZU’s data

Life insurance market in Poland

After three quarters of 2021, the life insurance market in Poland, measured by gross written premium, was estimated at PLN 16,563 million, meaning that over the most recent 5 years it contracted on average by 2.5% per annum, mainly due to changes in single premiums in investment products. At the same time, the premiums collected during the three quarters were 7.6% higher than those in the corresponding period of 2020, driven by an increase in both periodic and single premiums. Gross written premium in periodic premium products has increased both in life insurance (class I) and in accident and illness insurance (class V).

The changes in the level and the growth rate of the life insurance market premium in recent years have been stimulated mostly by single premiums in investment products. The changes in capital market trends and in the legal environment should be considered to be the underlying causes for the gross written premium on single premium business to fall in a trend over several years. The low interest rates and the tax on short-term endowment insurance products with fixed or index-based rates of return, which was introduced in 2015, contributed to the declining interest in those investment products and caused them to be gradually withdrawn from offer (mainly the fixed rate products). In subsequent years the guidelines of the regulatory authority, including those regulating the level of fees charged to clients of unit-linked products, as well as EU directives regulating the market for unit-linked products and their distribution led to insurance undertakings constricting their offering of these types of products, especially in cooperation with banks. After three quarters of 2018, the first sudden decline in single premiums was recorded (-31.7% y/y, of which -41.3% in the group of investment products) which was followed by downward movements in subsequent years. The volumes of single premium products have been recovering since Q3 2020, but they remain much lower compared to the previous periods.

Gross written premium reported by life insurer in Poland (in PLN million)

Source: KNF’s Quarterly Bulletin. Rynek ubezpieczeń [Insurance market] 3/2021, Rynek ubezpieczeń 3/2020, Rynek ubezpieczeń 3/2019, Rynek ubezpieczeń 3/2018, Rynek ubezpieczeń 3/2017

The outcome of these market changes was the expanding significance of periodic premium that constitutes PZU Życie’s competitive edge on the market. During the three quarters of 2021, premium with this payment form was 4.5% higher compared to the same period in 2020, with a cumulative average growth rate of 2.2% for the last 5 years. Despite the declining periodic premium in unit-linked life insurance (by PLN 118 million y/y), the premium on protection products in classes I and V increased (by PLN 694 million y/y) in both group and individually purchased insurance.

Life insurers – percentage of periodic gross written premium in Q1-Q3 2021 (%)

Groups: Talanx - Warta, Europa, Open Life; VIG - Compensa, Vienna Life; Aviva - Aviva, Santander-Aviva

* 9 April 2021 - KRS registration of the merger of AXA ŻYCIE TU S.A. (surviving company) and UNIQA TU na ŻYCIE S.A. (acquired company), effected by transferring all assets of UNIQA TU na ŻYCIE S.A. to AXA ŻYCIE TU S.A. and changing the name of the surviving company from AXA ŻYCIE TU S.A. to UNIQA TU na ŻYCIE S.A. On 9 April 2021, the acquired company terminated its activity

Source: KNF’s Quarterly Bulletin. Rynek ubezpieczeń [Insurance Market] 3/2021

At the same time, market concentration measured by the periodic gross written premium remained high. During the last year, the sequence of the five largest market players has not changed, even though their combined market share fell to 74.9%.

The total technical result generated by life insurance companies in Q1-Q3 2021 amounted to PLN 1,903 million, i.e. PLN 820 million less (-30.1% y/y) than in the corresponding period of 2020. The declines occurred both in life insurance classes (class I) and in accident and illness insurance (class V).

The drop in the technical result in life insurance (class I) by PLN 788 million was particularly significant, because a negative technical result (PLN -255 million) was recorded at the end of Q3 despite at increase in net earned premium. This was mainly due to a larger number of claims and benefits resulting from the higher number of deaths.

In this same period, life insurers generated a net result of PLN 1,487 million, down PLN 689 million (31.7%) y/y. This is the effect of the technical result being lower than in the corresponding period of 2020.

The total value of the investments made by life insurance undertakings at the end of Q3 2021 was PLN 41,452 million, signifying 0.5% growth compared to the end of 2020. In turn, the high investment performance of the funds contributed to a higher net asset value of life insurance in which the policyholders bear the investment risk (up 1.0% to PLN 49,072 million).

During Q1-Q3 2021, PZU Życie wrote 40.2% of the gross written premium of all life insurers on the market, signifying a decrease vs. the last year’s market share (by 2.2 p.p.). Even though the gross written premium of PZU Życie, both single and periodic, was higher than last year, other insurance undertakings recorded higher growth.

At the same time, PZU Życie continued to be the leader in the periodic premium segment. In the first three quarters of 2021, it generated 44.0% of these types of premiums, signifying a small decrease (by 1.6 p.p.) in the market share in this segment as compared to the previous year. The growth rate of gross written premium at PZU Życie in this segment was 0.8% y/y, while the other market players posted a 7.6% growth rate. PZU Życie reported an increase in the accident and health insurance segment (class V) and a decrease in the life insurance segment (class I), while other market participants reported increases in those two segments.

PZU Życie’s share in just the life insurance segment (class I) for periodic premiums at the end of Q3 2021 was 55.1% when measured by gross written premium and 57.5% when measured by the number of agreements in force. In turn, PZU’s market share in terms of the method of entering into an agreement just in the life insurance segment was 62.3% for agreements executed in group form and 36.0% for individual agreements (measured by gross written premium).

PZU Życie’s technical result represented 43% of the result earned by all life insurance companies. This evidences the high profitability these products enjoy. PZU Życie’s technical result margin on gross written premium was higher than the overall margin generated by other companies offering life insurance (12.3% versus 11.0%).

Life insurance market – gross written premium vs. Technical result (in PLN m)

| Life insurance market – gross written premium vs. technical result | 1 January - 30 September 2020 | 1 January - 30 September 2021 | ||||

| PZU Życie | Market | Market net of PZU Życie | PZU Życie | Market | Market net of PZU Życie | |

| Gross written premium | 6 519 | 15 395 | 8 875 | 6 654 | 16 563 | 9 909 |

| Technical result | 1 519 | 2 723 | 1 204 | 816 | 1 903 | 1 087 |

| Profitability | 23,3% | 17,7% | 13,6% | 12,3% | 11,5% | 11,0% |

Source: KNF (www.knf.gov.pl). Quarterly Bulletin. Rynek ubezpieczeń [Insurance Market] 3/2021, PZU Życie’s data

Insurance markets in the Baltic States and Ukraine

Lithuania

According to the Bank of Lithuania, in 2021 gross written premium on the non-life insurance market amounted to EUR 721 million. The last year’s decline of the market was offset; premiums were 8.5% higher than in the previous year and 6.8% higher than in 2019. The market grew mainly in property insurance, which represents roughly one fifth of the entire non-life insurance market. Gross written premium in property insurance rose 16.4% y/y in 2021. Motor insurance remains the most significant insurance class on the market (representing 56.8% of all gross premiums written in non-life insurance). Due to the strong price competition, the value of sales in TPL motor insurance fell by 1.0% compared to last year. The value of motor own damage insurance sales increased by 9.4%. Sales of health insurance grew dynamically: gross written premium increased by 25.7% to EUR 64 million.

As of the end of December 2021, there were 13 companies operating in the non-life insurance sector, including 8 branches of insurance companies seated in other EU member states. The combined market shares of top 4 players in the non-life insurance market totaled 69.1%.

The PZU Group has been present in Lithuania since 2002. As of November 2014, it has conducted its activity on the non-life insurance market as Lietuvos Draudimas, which, as of May 2015, is also the owner of the PZU branch in Estonia.

Lietuvos Draudimas is the leader of the non-life insurance market in Lithuania. Its market share was 29.7% in 2021. Lietuvos Draudimas posted an increase in gross written premium by 8.8% y/y to EUR 214 million. The biggest growth was achieved in property insurance (up EUR 7 million) and MOD motor insurance (up EUR 6 million), while sales of TPL motor insurance fell by EUR 1 million.

Gross premiums written by Lithuanian life insurance companies in 2021 were EUR 319 million, up 9.8% relative to 2020. Sales of regular-premium insurance increased by 8.6% y/y, mainly due to higher volumes of new sales. Sales of single-premium insurance products increased by 30.4% y/y (i.e. by EUR 5 million). The growth was particularly pronounced at yearend, driven by tax relief.

In the life insurance structure, unit-linked insurance represented the largest share at 68.1% of the portfolio value. Traditional life insurance accounted for 12.3% of written premium.

New sales increased by 29.7%. Despite the limitations related to COVID-19, all life insurance companies achieved high growth in new sales. It was still only 2% higher than new sales generated in the year before the pandemic (2019).

As at the end of December 2021, 8 companies operated in this sector. The Lithuanian life insurance market is highly concentrated – in 2021, the share held by the three largest life insurance companies in total gross written premium was 61.6%.

Swedbank was the largest life insurance company in Lithuania in terms of total gross written premiums, with a 22.6% market share. The next players are Compensa (19.9% market share) and Aviva (19.1% market share).

PZU Group’s life insurance operations in Lithuania are conducted through UAB PZU Lietuva Gyvybës Draudimas (PZU Lithuania Life). The gross written premium posted by PZU Lithuania Life was EUR 21 million, up 10.8% from 2020. This corresponds to a market share of 6.5% (+0.1 p.p. y/y).

Latvia

On the Latvian non-life insurance market, gross written premium was EUR 402 million in 2021. This is EUR 22 million (i.e. +5.8%) more than in the previous year.

The biggest growth was achieved in property insurance and health insurance – up EUR 18 million and EUR 6 million, respectively. The biggest drop was observed in the TPL motor insurance area (down EUR 10 million) driven mainly by a decrease in insurance rates.

Motor insurance is the most important insurance class. Third party liability (TPL) insurance and motor own damage (MOD) insurance accounted for 19.8% and 22.7%, respectively, of the entire non-life insurance market in terms of gross written premium. Property insurance (24.5% of gross written premium) and health insurance (19.1% of gross written premium) also had an important position in the product mix.

At the end of 2021, there were 10 insurance companies operating on the Latvian non-life insurance market; the top 4 insurance groups held 72.3% of the market.

From June 2014, the PZU Group was joined in Latvia by AAS Balta, which in May 2015 took over the PZU Lithuania branch operating in the Latvian market since 2012.

In 2021, the gross premium written by AAS Balta reached EUR 116 million, up 8.1% (EUR 9 million) relative to 2020. The largest growth was recorded in property insurance as well as travel and health insurance. At the same time, sales of motor insurance fell due to strong price pressures.

At the end of 2021, the share of AAS Balta in the non-life insurance market was 28.8%.

Estonia

Gross written premium of non-life insurance companies operating in Estonia posted a 4.2% increase in gross written premiums up to EUR 400 million. 36.2% of this amount, i.e. EUR 145 million, was collected by branches of foreign insurers operating in Estonia.

The key contributor to market growth was MOD motor insurance, which increased 5.3% y/y, financial insurance (+29.9% y/y) and property insurance of natural persons (+5.6% y/y). Health insurance also grew dynamically, with premiums nearly doubling at EUR 4 million. At the same time, sales of TPL motor insurance fell 4.0% y/y (i.e. EUR 4 million) due to persistently low prices of insurance.

The sales structure of non-life insurance did not change significantly in 2021: it was dominated by motor insurance, which accounted for 55.2% of gross written premium (of which MOD insurance accounting for 31.4%), with property insurance accounting for 28.7% of gross written premium. On the other hand, the share of health insurance increased to 1.5% (i.e. +0.9 p.p y/y).

At the end of December 2021, there were 13 companies operating in the non-life insurance sector (including 5 branches of foreign insurance companies) among which the top 4 held a combined market share of 68.4%. LHV Kindlustus, the new Estonian insurer, which started actively selling motor, housing, travel and TPL insurance in 2021, reached a 1.7% market share at the end of the year.

Since May 2015, the PZU Group’s operations in Estonia have been conducted by the Lietuvos Draudimas branch, established as a result of the merger of two entities: the branch of PZU’s Lithuanian subsidiary and the Estonian branch, which operated under the Codan brand.

The PZU Group’s share in the Estonian non-life insurance market in 2021 was 14.5%, and the accumulated gross written premium was EUR 58 million, up 3.4% (i.e. EUR 2 million) relative to 2020.

The biggest growth was achieved in property insurance and MOD motor insurance. At the same time, due to the persisting price pressures in the region, the sales of TPL motor insurance declined (the average premium went down 4% in the mass segment and 1% in the corporate segment).

Ukraine

As of the end of June of the 2020, the supervision over the insurance market in Ukraine was taken over by the National Bank of Ukraine. This change resulted in, among other things, final implementation of the regulations on the solvency levels required of insurance undertakings, which, in turn, led to termination of operations by some entities.

After the first three quarters of 2021, The Ukrainian insurance market, measured by gross written premium, grew by 15.5% up to UAH 38 billion.

The premium accumulated in non-life insurance was UAH 33.9 billion, signifying 15.3% growth compared to the same period in 2020. The National Bank of Ukraine oversees the compliance of insurance market players with the applicable regulations and applies appropriate measures against the entities that violate them. In most cases, the market players decided to suspend their activity voluntarily: 38 insurance undertakings left the market during the first 9 months of 2021.

In the first quarter of 2021, periodic restrictions related to the COVID-19 pandemic had a significant effect on travel and Green Card insurance. In the following quarters, as the restrictions were gradually lifted, the deferred demand was activated and at the end of Q3 both insurance types recorded sales growth at 44.6% and 36.4%, respectively, as compared to Q1-Q3 2020. At the same time, the MOD motor insurance market (up 28.2% y/y) and the health insurance market (up 24.5% y/y) were also gradually recovering.

As at the end of September 2021, insurance companies offering life insurance collected gross written premium of UAH 4.2 billion, signifying 17.2% growth compared to the corresponding period of the previous year.

The Ukrainian insurance market is highly fragmented. As at the end of September 2020, there were 169 insurance companies operating in the country, 17 of which offered life insurance. Despite the large number of insurers, the top 50 non-life insurers generated 92% of gross written premium.

On the Ukrainian market, the PZU Group operates insurance business via two companies: PrJSC IC PZU Ukraine (PZU Ukraine) (a non-life insurance company), and PrJSC IC PZU Ukraine Life (PZU Ukraine Life) (a life insurance company). In addition, LLC SOS Services Ukraine offers assistance services.

In 2021, gross written premium collected by PZU Ukraine amounted to UAH 1,746 million, or 17.5% more than in the previous year. Sales growth was recorded in all business lines, with the most significant ones in motor and travel insurance. In 2021, gross written premium collected by PZU Ukraine Life was UAH 635 million, up 18.1% from 2020.

During three quarters of 2021, PZU Ukraine attracted 3.8% of the gross written premium on the Ukrainian non-life insurance sector, maintaining its market share vs. Q3 2020. This ranked the company seventh on the non-life insurance market in Poland. PZU Ukraine Life ranked third in the life insurance market with a 15.2% market share (up 4.2 percentage points relative to the previous year)1.

1 Insurance TOP, Ukrainian Insurance Quarterly, #7(83)2021

Activity and product offering of PZU Group’s insurance companies

PZU Group offers non-life insurance in Poland under three brands: PZU, the traditional and most well-known brand, LINK4, associated with direct sales channels, and TUW PZUW, i.e. the mutual insurance company Life insurance is sold in Poland under the PZU Życie brand. Outside of Poland, the PZU Group sells insurance products under the PZU brand (in Ukraine), as Lietuvos Draudimas (in Lithuania and Estonia) and as Balta (in Latvia).

To address expectations voiced by clients, the PZU Group has been consistently extending its offering in recent years for both retail and corporate clients. As a result, it has been able to retain its high market share.

Activity and product offering - PZU

As the PZU Group’s parent company, PZU offers an extensive array of non-life insurance products, including motor insurance, property insurance, casualty insurance, agricultural insurance and third party liability insurance. At yearend 2021, motor insurance was the most important group of products offered by PZU, both in terms of the number of insurance agreements and its premium stated as a percentage of total gross written premium.

Faced with changing market conditions, PZU realigned its offering in 2021 to clients’ interests and needs by rolling out new products and innovative solutions.

PZU’s activities in the mass insurance segment:

- extension of coverage of the PZU AUTO Assistance product to include two Truck Assistance options: Comfort Truck and Super Truck, addressed primarily to carriers with heavy fleet, i.e. trucks with gross vehicle weight exceeding 3.5t, truck tractors, buses, trailers over 2t, semi-trailers, fire-fighting vehicles. In the new options, in case of an incident on the road, PZU organizes and covers the cost of: repairing the vehicle on site, towing and cleaning the accident site, removing a vehicle blocking traffic (on a steep slope, a narrow roundabout or a dead end), supervising cargo, transport to a hospital, travel of a substitute driver and many other services. Extension of the PZU AUTO Assistance product complements the offering for corporate and SME clients. In particular, it strengthens the Company’s position in the heavy vehicle fleet segment. The advantage for PZU is the availability of the new product in any suitable form: individual policies, fleet contracts and leasing programs, in all distribution channels;

- implementation of new forms of PZU Auto insurance documents in accordance with the plain language principles. The simple PZU Auto policy is another step to changing communication with clients to one that is user-friendly and consistent with the national plain language standard. The new document forms include: offers, policies and the confirmation of entering into an insurance agreement. In H2 2021, the functionality of new templates was extended by adding, among others, support for new payment forms: subscriptions and sharing for new entities, in the role of e.g. lender, borrower, lessor, lessee and CFM manager or renter;

- addition of PZU Home to be serviced in Radar Live – a pricing tool enabling a better alignment of the offering with the client’s expectations and risks;

- sending the Green Card Certificate in PDF format to the specified e-mail address for self-printing. Simplification of the current process ensures security for both clients (no need to visit the branch or agent) and employees;

- launching a light sales front for SME property insurance products (PZU Firma and General TPL), to support agents in selecting an insurance cover that suits the profile of the client’s business activity and in preparing an offer;

- introducing a subscription payment, which is a unique solution on the non-life insurance market. The subscription may be used by private individuals, who purchase PZU Auto, PZU Dom, PZU Plan na Zdrowie, PZU ADD, PZU Edukacja, OC w Życiu Prywatnym insurance products. Payments can be made with a traditional or fast transfer, BLIK or card. Currently, the subscription covers six most popular insurance types, but PZU plans soon to add more policies to the offer. Thanks to the new solution, a client may easily pay for all of his/her policies with a single monthly transfer, distributing the premium over 12 payments in a year.

Most of the changes in the corporate insurance segment, on which PZU focused its attention, increased the effectiveness of collaboration with intermediaries and the appeal of the dedicated offering for fleet clients and leasing companies.

Major new products included:

- development of the Risk PRO program – a comprehensive system to prevent property losses of companies insuring their business in PZU. The program has been designed for the industries, in which the risk of a loss is high due to the scale of their business and specialized production processes. The solution uses technologies based on the Industry 4.0 concept, monitors the level of safety in key areas of the company’s activity, which are material from the risk perspective (e.g. production, logistics, machinery). The program is free for clients having an active insurance cover in PZU. The program has already passed the pilot phase and currently it is used in several work establishments serviced by PZU. The clients covered by the pilot suffered no significant losses during the pilot. Risk PRO, which is provided by PZU in cooperation with PZU LAB, implements the goal of support for corporate clients, frequently emphasized in the Group Strategy for 2021-2024. The risk management solution is unique on the market and promotes the idea of industry that is safe and compliant with the ESG ideals;

- introduction of a new Truck Assistance insurance for owners of trucks, truck tractors and buses. In case of an accident or vehicle failure, truck assistance ensures quick help for the driver – including repair of damages, replacement vehicle, tire replacement or towing services. Truck Assistance also offers support in the event of a dead battery, running out of fuel or locked keys. In the Super Truck option, the insurer will organize accommodation for the time of repair and in the event of an illness or bodily injury it will transport the driver to a hospital an organize travel for the replacement driver. The insurance is added to the offer for corporate and SME clients;

- pilot launch of the new iFlota system, which combines the fleet management and security functionality with fleet insurance management. The tool will be addressed to clients as well as insurance intermediaries. The offer includes access to data about insurance, claims as well as fleet management functions, such as management of fuel cards, registration of vehicles, drivers, repair costs, etc. The new system is to be launched in order to improve security of fleets through access to e-learning courses, knowledge databases, or suggested preventive measures.

In financial insurance, PZU was unswerving in its support for the Polish economy by providing insurance guarantees and securing the performance of contracts in such key areas as the power sector, the construction industry and the science and innovation sector. One of the activities associated with the product offer in the financial insurance area was adaptation of the guarantee forms to the market requirements and adaptation of e-toll guarantees to the changes introduced in the e-toll system.

Activity and product offering - LINK4

LINK4 was the first insurance undertaking in Poland offering products by phone; it remains one of the leaders on the direct insurance market, while it also extends its activities to cooperation with multi-agencies, banks and strategic partners. The company offers an extensive array of non-life insurance products, including motor insurance, property insurance, casualty insurance and third party liability insurance.

Given the changing market situation, the company has zeroed in on the development of innovative solutions providing added value to both its clients and business partners. By using new technologies in internal processes and in relations with clients, the company continues to challenge the way of thinking about insurance. At the end of 2021, LINK4 had 60 processes that were fully robotized and 12 applications supporting day-to-day tasks of its employees. LINK4 continues the data-driven digital transformation, while placing the main emphasis on analytics and smart automation. There is currently more than a dozen operational machine learning models, which support the sales, claims handling and service processes.

In H2 2021, the company introduced new rules for assigning sales budgets based on advanced analytics, which aimed at maximizing their efficiency. LINK4 also placed greater emphasis on activating the whole multiagency network to use more of its potential, by measuring the so-called network activity ratio. At the same time, the work on development of a mobile application for agents continued, which should facilitate communication between agents and LINK4.

The special recognition enjoyed by LINK4 on the market and among its employees is confirmed by the title of the Best Quality Employer 2021. The award granted by Centralne Biuro Certyfikacji Krajowej places LINK4 among the best employers in Poland. LINK4 was also awarded the prestigious title of Investor in Human Capital for its exceptional above-average employee satisfaction and engagement. This is very important, especially since the study covered the difficult period of the pandemic and remote and hybrid form of working.

In 2021, LINK4 focused on expanding further its current product offering, adapting it to the changing expectations of its clients and business partners. The most important activities linked to modifying its product offering were as follows:

- amendment to the GTCI for motor own damage insurance, including introduction of more precise provisions aimed at, among others, making the claims handling process easier, and amendment to the GTCI of the Assistance Scheme – expanding its scope to include assistance in case of battery failure;

- development of the new product, LINK4Medica, the implementation of which has been planned for 2022 (delayed from H2 2021).

Activity and product offering – TUW PZUW

Towarzystwo Ubezpieczeń Wzajemnych Polski Zakład Ubezpieczeń Wzajemnych (TUW PZUW) offers flexible insurance programs customized to the needs of the insured in terms of insurance cover and costs of the cover. Since 2016, it has been selling and handling commercial insurance products for various industries, focusing predominantly on cooperation with large enterprises, medical centers (hospitals and clinics), church entities and local government units.

At the end of 2021, the number of members exceeded half a thousand, i.e. 518, up 86 from the end of 2020.

TUW members are grouped by specific criteria (industry, corporate, risk types) in 57 mutual benefit societies (5 more than there were in the previous year).

TUW PZUW is consistently attuning its operating model to the growing scale of business by expanding its team of professionals, who provide comprehensive service of its members’ insurance and tailor the offering to the members’ individual preferences. As the only mutual insurance company in Poland, TUW PZUW enjoys high ratings from the S&P rating agency. It was also included in the prestigious ranking of the companies that can be trusted, developed by the “Home&Market” monthly.

In 2021, TUW PZUW focused on expanding further its product offering, adapting it to the changing epidemic conditions as well as expectations of its clients and business partners. Its key activities included:

- launching the offer of new insurance products: “Siła Wiatru” for wind farms and “Moc Słońca” for photovoltaic installations, promoting renewable energy sources and furthering the goals pursued by the Strategy for 2021-2024. It is a comprehensive property insurance against all risks, including against damage and loss of profit, as well as liability insurance associated with the operation of wind turbines and photovoltaic panels, addressed to corporate clients. It is yet another environmentally-friendly project of TUW PZUW, after insurance of photovoltaic panels for individual clients offered as part of an affinity program;

- expanding the offer for church institutions by adding another custom product, TUW Podróż. The insurance may be taken out by clergy and consecrated persons who go on missions, visit missions, or travel abroad for any other purpose. The agreement is signed for one year and is effective worldwide. It is offered in three options where the price depends on the guaranteed sum insured. The policy has an important feature, i.e. comprehensive assistance in case of problems that may arise during trips – legal assistance and interpreter services, financing of accommodation during convalescence abroad or early return home, delivery of necessary items from home or even a visit of a loved one. TUW PZUW also offers assistance in the continuation of treatment or rehabilitation after returning to Poland. The insurance also covers third party liability and luggage of the insured, as well as accidents;

- introduction of the market-first business risk insurance for franchisees. “Polisa na biznes” is a solution designed for smaller businesses associated with franchising networks. The insurance responds to market needs and supports smaller entrepreneurs, for whom financial security is the key factor considered when making decisions to launch their own business. The policy offers protection against business risk, e.g. insolvency, if the situation forces the entrepreneur to cease his or her business activity. “Polisa na biznes” will be first available to more than 6,000 franchisees of Żabka, a chain of convenience stores;

- extension of the offer for medical entities to include an innovative solution for hospital groups, i.e. an umbrella cover. It protects the facilities from the necessity to cover the expenses themselves after the guaranteed sum under mandatory insurance is exhausted. It also offers protection for the potential injured parties, who will have an easier path to obtaining compensation;

- introduction of a third party liability insurance for directors and officers of a medical treatment entity – offering comprehensive protection against the consequences of management errors, among others:

- non-performance or undue performance of a contract with the National health Fund,

- breach of the rules of public finance discipline – in the case of entities with the State Treasury or local government shareholding;

- violation of tax regulations or accounting principles.

Activity and product offering - PZU Życie

Within the PZU Group, PZU Życie operates on the Polish life insurance market. The company offers an extensive range of life insurance products, which for management purposes are reported and analyzed broken down into the following three segments:

- group and individually continued insurance;

- individual insurance;

- investment contracts.

PZU Życie, as a popular and the largest insurer on the Polish market, continuously expands its offering by adding new products or modifying existing ones to protect its clients at each stage of their lives. The unique synergy of competences within the PZU Group (insurer, medical operator, investment manager) allows the company to comprehensively take care of life, health and savings of its clients, providing them with the broadest possible support in accordance with their expectations and needs.

The changes concern not only to the product itself but also entail the modernization and simplification of the way in which insurance is offered and sold. They also enable the client to take advantage of various contact channels to reach the insurance undertaking (e.g. in a branch, by phone, e-mail, Internet client account, person providing technical insurance services in the workplace or through an insurance intermediary, whether tied or external).

The changes incorporate the new requirements introduced by the regulatory authority and the increasing legal protection of consumers.

Activities of PZU Życie under group, individually continued and health insurance included:

- adding a new voluntary malignant neoplasm insurance rider to the Individual Continuation (IK) group insurance. The rider is available for both new and existing IC clients up to 80 years of age. The insurance provides financial support in the event that a malignant neoplasm is diagnosed;

- launching a new insurance bundle PZU Support in life and health. The new product has 21 options offering a range of benefits, sums insured and premium levels: 18 options for clients aged 18-59 and 3 options for clients aged 60-69. Under the insurance cover, the client may, among others, receive a payment in the event of an illness or an accident, or take advantage of medical services in case of various health problems. The simplicity of the product and the speed of purchase allows the company to use the potential of external and internal sales networks focused on mass non-life insurance clients;

- update of the offer for people up to 59 years of age, who have the right to Individual Continuation of group insurance. The refreshed PZU Continuation for You Plus product ensures a broad insurance cover, flexibility in selecting the insurance cover and the possibility of adding medical care to the product;

- launching pre-defined packages for the PZU Cover and Health and PZU Życie under Cover insurance, built around the main product advantages. It is a comprehensive response to the client's need

PZU Życie’s efforts in the area of individual protection insurance and protection and unit-linked insurance:

- revitalization of the individual life insurance offer, entailing among others:

- lowering the technical rate from 1.5% to 1% adjusting it to the new maximum technical rate announced by the KNF Office on 29 January 2021 (change from 1.76% to 1.32%) in PZU Gwarantowane Jutro, PZU Na Dobry Początek, PZU Wsparcie Najbliższych insurance products,

- adding the option of increasing the sum insured without risk assessment in the PZU Ochrona Każdego Dnia term insurance, adding the option of changing the sum insured in PZU Ochrona Każdego Dnia term insurance,

- separating indexation from profit-sharing in PZU Gwarantowane Jutro, PZU Na Dobry Początek, PZU Wsparcie Najbliższych insurance products, which created a separate premium indexation mechanism (which will index the premium and the benefit amount) and a separate profit-sharing mechanism (which can increase the sum insured without changing the premium amount),

- increasing the minimum premiums and adapting them to the current market conditions and the purchasing power of money,

- extending the grace period for premium payment, as a result of which a policyholder may benefit from a new, extended grace period for premium payment (when he/she keeps the insurance cover even if due premium is not paid) from 1 month to 2 months of the agreement;

- allowing individual clients of PZU Życie to join the Opieka Medyczna S (OMS) insurance. The insurance is available in two options: Standard and Comfort, which offer a different scope of laboratory and imaging tests and the number of available specialist physicians;

- offering insurance riders to clients who already have individual insurance in PZU Życie;

- increasing the limit, which allows the PZU Wsparcie Najbliższych whole life insurance product to be purchased without the need to fill out a medical questionnaire and undergo full risk assessment.

The numerous changes introduced over the past year have made PZU’s individual life and health insurance offer one of the broadest and the most competitive in the Polish market.

In individual pension insurance, the major moves related to the change of the product offer included:

- modification of PZU IRSA (Individual Retirement Security Account) insurance to adapt it to the amended regulations effective as of 1 January 2021. From this date, the IRA and IRSA Act introduced a new amount limit for persons who conduct non-farming business activity. These persons may pay into IRSA up to 1.8 times the average forecast monthly salary in the national economy for the given year. Other clients may pay into IRSA up to the limit of 1.2 times the average forecast monthly salary for the given year;

- adaptation of IRA (Individual Retirement Account)) to the current market conditions, by changing the list of unit-linked funds available in the product and applying TFI funds with a cheaper participation unit category.

Activity and product offering – foreign companies

Lietuvos Draudimas

Lietuvos Draudimas is the largest and the most experienced insurer, the leader of the Lithuanian insurance market and the largest insurance company in the Baltic States. Every third resident of Lithuania chooses insurance in Lietuvos Draudimas. In 2021, in addition to the current activity in non-life insurance, Lietuvos Draudimas continued to focus on expanding further its product offering, while adapting it to the changing circumstances and expectations of its clients.

The most important activities included:

- motor own damage (MOD) insurance for individual clients, which was updated at the end of 2020, offering more favorable terms with regard to replacement vehicles, and adding new technical assistance options. In March 2021, the company launched sales of this insurance also on the Internet platform, which impacted the sales results significantly. The work on additional improvements in the sales process is continuing;

- property insurance of individual clients – in 2020, new clients were offered two additional options in the “Home” and “Home Plus” insurance, in which the sums insured in TPL insurance were increased and the term of the cover was extended (12+3 months). Similar activities were restarted in the period of May-August 2021 and renewed regulations were introduced in April offering a broader insurance cover;

- ADD insurance for families, whose option “Two insurance products as a gift” was introduced into sales in 2020. In 2021, the campaign was relaunched in the period from July to November, with the offer extended by additional risks, including COVID-19. The extended insurance offer was in effect until the end of the year, with an extension option. The additional insurance protection implemented in travel insurance products covers COVID-19 risks and is available for additional premium during short trips only (up to 31 days);

- health insurance – after analyzing the needs and expectations of customers, Lietuvos Draudimas was the first insurance company on the market to introduce health insurance for individual customers in January 2021. At the same time, after assessing the situation in the country and the importance of remote services, Lietuvos Draudimas added a fee for remote medical consultations to the health insurance package and established cooperation with Mano Daktaras (My Doctor), an electronic system for booking a visit with a specialist or receiving a consultation online.

PZU Lithuania Life

In 2021, the focus was on implementing significant changes in the product area. In early 2022, a modern product named Mylintiems gyvenimą (For Those Who Love Life) was launched, offering the broadest life insurance cover on the market. The goal is to provide clients with consistent, comprehensive daily support and make sure that anyone can create custom whole life insurance suited to their needs and capacity.

The company also worked on the project of refreshing the LICOSS sales system, in order to obtain a more efficient system supporting both direct and remote sales processes. The entire sales process was analyzed and a new innovative tool enabling a more precise identification of client needs was implemented in the sales system.

During the year, the process of remote identification of adult insured clients was fully implemented. The process of remote identification of minors was launched, developed and prepared for implementation.

The cooperation with Lietuvos Draudimas was strengthened and, in order to achieve synergies and increase the number of recommendations, the process of obtaining clients’ marketing consents through their self-service in Lietuvos Draudimas was commenced.

Broad assortment of products, excellent customer service and well-thought out investments in brand promotion activities allowed Balta to maintain its leading position on the Latvian non-life insurance market in terms of sales volume and significantly strengthen the leading position through brand awareness and reputation.

In 2021, the increase in sales was driven, among others, by products added to the offer in the previous year to address the changing customer needs. These products include: crop insurance, extended warranty insurance, liability insurance for real estate intermediaries and accident insurance against COVID-19-related risks.

In 2021, Balta also modified some of its existing products:

- in Motor Own Damage (MOD) insurance, the cover was extended to include an additional risk related to luggage outside of a car;

- in travel insurance, the cover now includes COVID-19-related risks; if a trip must be canceled due to a COVID-19 infection or a duty to undergo a quarantine, Balta will cover the costs already incurred in connection with the planned trip; it also covers the cost of treatment and will pay a benefit for hospitalization in case of an infection.

New motor assistance products were also launched in cooperation with partners.

Lietuvos Draudimas – branch in Estonia

At the end of 2020, the Lietuvos Draudimas branch in Estonia introduced a new health insurance product, with which the company asserted its presence on the fast-growing health care market. In the first half of 2021, the focus was on product development in the production system and on the self-service platform, which enables participation in larger tenders; sales through the platform were launched in July.

In the TPL motor insurance, the option of making monthly payments was implemented in the Internet sales channel for annual policies.

In order to improve the management of past due payments, the SMS project was launched: a policyholder receives a text message with a reminder whenever an installment is not paid. The project has achieved the expected results and had a positive effect on collections.

The company’s main distribution channels are its partners, SEB Bank and the Internet. In order to improve its operating efficiency, synergies and cross-selling in all direct distribution channels, at the end of 2021 the company launched the project of building its Own Sales Network. The sales are expected to be launched in H2 2022.

In 2021, PZU Ukraine carried out a project and conducted analysis and studies to tidy up its product portfolio. A number of changes were made in the product range, with the key ones being:

- update of the tariff policy and the terms and conditions of insurance in the TPL and MOD insurance area;

- revision of travel insurance, to enable its sales on online platforms (Hotline, EWA and Jobian);

- update of the terms and conditions for policies offered by PZU Ukraine at visa centers.

At the same time, in an effort to address client needs and improve the quality of customer service, an innovative technology was introduced in property insurance of individual clients that allows clients, during the claims handling process, to take and deliver photos themselves in low-value claims. This option is offered by the Object control mobile application.

PZU Ukraine Life

In the first half of 2021, PZU Ukraine Life launched a new Life chat-bot service for clients. Its task is to carry out consultations with clients and provide additional information. The service is partially automatic when it provides forms of documents and general information on contracts and products. If any individual requests are made, the additional information is provided by contact center operators. The service is very popular among clients. It is used by more than 1,000 customers per month and about 50% receive answers to their questions without the need to involve contact center operators.

In 2021, the mailing of paper indexed insurance certificates was abandoned, switching to electronic form. This sped up transmission of information to clients significantly. The goal is to switch to electronic form exclusively in 2022, which will encourage clients to actively register their e-mail addresses and cooperate with PZU Ukraine Life by using the Life Customer Office.

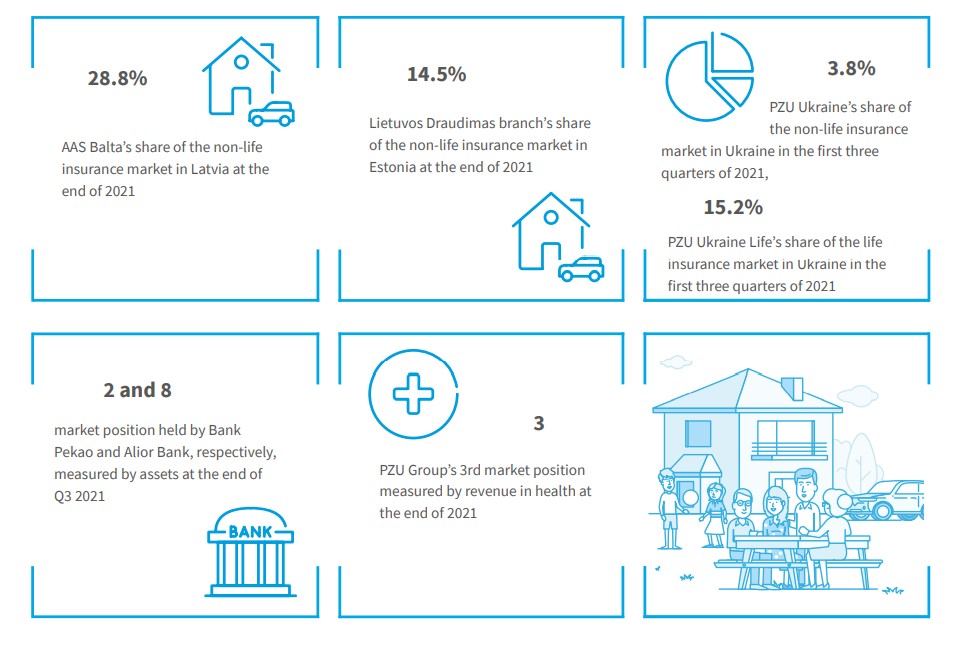

Distribution and customer service

PZU Group’s sales network is organized in a manner that ensures sales effectiveness along with high quality services. Among all the Polish insurers PZU offers its clients the largest sales and service network. It has 409 branches across the country with 189 in small communities and tied agents, multiagencies, insurance brokers and electronic distribution channels.

In 2021, the PZU Group’s distribution network included the following:

- tied agents – in Poland the PZU’s own agency network consisted of 9.7 thousand tied agents and agencies. Sales are conducted through the agency channel predominantly in the mass client segment, particularly of motor and non-life insurance as well as individual insurance (life insurance). LINK4 cooperated with 350 agents not tied to any aggregator. In the Baltic States the Group’s agency network comprised over 660 agents, while in Ukraine there were 392 agents;

- multiagencies – on the Polish insurance market, the PZU Group cooperates with more than 3.2 thousand multiagencies. They perform sales operations targeted mainly at the mass market (insurance of all types is sold through this channel, especially motor insurance and property insurance) as well as individual life insurance. LINK4 cooperated with 50 multiagencies, while in the Baltic States Group companies cooperated with 20 multiagencies and in Ukraine with 26 multiagencies;

- insurance brokers – in Poland, the Group, in particular PZU’s Corporate Client Division, cooperated with over 1 thousand insurance brokers. In the Baltic States where the brokerage channel is a major insurance distribution channel, the Group companies cooperated with over 455 brokers and in Ukraine with 35 brokers;

- bancassurance and strategic partnership programs – in the insurance area, PZU and PZU Życie cooperated in Poland with 8 banks and 11 strategic partners, TUW PZUW with 1 bank and 7 strategic partners, LINK4 cooperated with 6 banks in different sales models – traditional through OFWCA with about 13 thousand sellers, online and call center. and 4 strategic partners. In the Baltic States, the cooperation included 6 banks and 13 strategic partners and 10 banks in the Ukraine;

- the direct channel – non-life insurance sales through this channel is conducted in particular by LINK4 and comprises cooperation with price comparison engines, website and call center (245 consultants). This channel comprises also the mojePZU portal.

Branches and agencies

Bulk of PZU’s clients prefer direct service by the agent and in the agent’s office.

The network of 409 standardized PZU branches is evenly distributed across Poland in carefully selected locations. PZU branches are the only distribution channel ensuring in each outlet comprehensive sales and aftersales service of PZU Group’s non-life, life and pension insurance and investment products. The offering in PZU branches is targeted at individual clients as well as businesses from the small and medium-sized enterprise (SME) segment.

Branches and agiencies

PZU continues to develop the professional agency sales network. Agent offices offer spacious and modern layouts and the quality of service appreciated by millions of clients. Continuous work is conducted on professionalizing the network and improving the quality of customer service, through attractive training courses and workshops. Agents actively use modern CRM and remote service systems such as mojePZU. Most agents running offices offer advice regarding the clients’ property, life and health insurance. They provide clients with comprehensive service as part of the product offering of the entire PZU Group.

PZU supports agents by developing and promoting their online presence, as clients show great interest in seeking contact with an insurance consultant using this particular channel. The www.agentpzu.pl site is continuously developed as well as agents’ websites in the agentpzu.pl domain. Support is also provided through management of Google business cards of the agency establishments and joint administration of agents’ professional Facebook profiles.

At the end of 2021, the number of the PZU’s tied agent offices was greater than 1490.

Distribution network

moje PZU

The launch of the mojePZU [myPZU] portal in 2018 was a way of fundamentally modifying client interactions. This is a one-of-a-kind dashboard enabling clients to check their insurance cover at any time, manage their medical coverage and appointments as well as their investments. Through the mojePZU portal, PZU Group clients may:

- buy a motor, home or travel policy and medical packages;

- view their policies and report changes;

- make an appointment with a physician;

- collect a referral for examination or an e-prescription;

- check their medical records;

- invest their savings;

- report a claim and check its current status.

Modern self-service offers a single location to access PZU Group’s products and services and helps in the handling of numerous matters without the need to visit a branch or contact a hotline. It is accessible from any location and at any time on personal computers and through the mobile app. At the end of December 2021, the mojePZU portal had more than 2.5 million users.

The service is continuously developed and supplemented with additional functions, in the area of insurance sales and renewals, claims and benefits handling, as well as health and investment areas, the PZU Pomocni Club loyalty program, or new products such as PZU Sport (sports and leisure subscription offer).

Bank channel

Distribution of insurance via the banking channel is an important element of the PZU Group’s business model. Cooperation with the banking segment forms an additional plane for PZU to build lasting client relations at every stage of their personal and professional development.

PZU’s activity is based mainly on the area of bancassurance, assurbanking in cooperation with banks from the PZU Group: Alior Bank (in PZU Group since 2015) and Bank Pekao (in PZU Group since 2017) and distribution of bancassurance insurance products through banks outside the Group.

The overriding objective of the cooperation is to reach the largest number of clients using multiple distribution channels and provide insurance cover to bank clients.

In the PZU Group Strategy in 2021–2024, the cooperation with banks and other non-financial partners is one of the Group’s priorities. By actively cooperating with Bank Pekao and Alior Bank, PZU continues the implementation of a comprehensive offering using the banks’ distribution networks. This cooperation has allowed PZU to steadily expand the offering and scale of sales of insurance products linked to bank products, including insurance coverage for cash loans and mortgage loans. Over the term of the strategy, the Group plans to generate roughly 3 bn PLN1 of cumulative gross written premium on insurance and banking collaboration with Bank Pekao and Alior Bank.

In 2021, cooperation with Bank Pekao and Alior Bank included:

- in bancassurance:

- with Bank Pekao

- cooperation in offering insurance for mortgage loans, cash loans and for personal bank accounts,

- investment products,

- sales of travel insurance;

- with Alior Bank

- sales of non-life and life insurance for cash borrowers and for mortgage loan borrowers,

- sales of travel insurance;

- in assurbanking:

- as part of end-to-end sales, in the remote channel, PZU successively launches new banking products – currently these are Przekorzystne Konto andbPrzekorzystne Konto Biznes accounts offered by Bank Pekao;

- all PZU’s own branches launched a joint campaign entitled “Auto plus account” (TPL 10% + ROR PLN 200), supporting the sale of motor TPL insurance and the Bank Pekao Konto Przekorzystne account. The Konto Przekorzystne promotional offer is available also in the sale of PZU Dom and School ADD products. The year 2021 also saw the roll-out of the Auto plus Account offer into Partner Branches and the launch of pilot sales of two banking products in the Tied Agent network, namely a personal bank account in the Auto plus Account promotion and a cash loan. PZU is one of the largest external partners of Bank Pekao in the sales of personal bank accounts (RORs) via the bank’s Pekao360 app;

- the Cash Portal, an innovative loan platform with a unique product offering for employees was being developed together with Alior Bank. In 2021 the portal was made available to other companies – the overall reach of the Portal in large companies was more than 100 thousand employees. The product portfolio on offer was also extended – by Alior Bank’s consolidation loan and a Mini Cash short-term loan fully funded with the equity of PZU Cash SA. The Cash Portal is a good example of synergy and leveraging the strengths of the two companies in the PZU Group, implementation of an innovative business model and following the market trends – in this case the trends pertaining to financial wellbeing. The Cash Portal also follows the development of remote channels, making it possible to use financial products 100% online, which is particularly important in the face of the COVID-19 pandemic.

In H1 2021, PZU Życie launched the sales of endowment insurance in the bancassurance channel. In the case of unit-linked products, sold by Bank Millennium, Bank Pekao and Alior Bank, in 2021 promotional prices were offered to clients, which increased the attractiveness and competitiveness of the offer in the market. These products were removed from the offer as of 24 December 2021 and new products compliant with the KNF’s product intervention requirements were introduced in Bank Pekao and Alior Bank in January 2022. The new design of the products will reduce costs to clients.

Moreover, in Q3 2021, PZU Życie implemented modified insurance for Bank Millennium borrowers; the cover was extended to also include the insured’s inability to work and exist independently due to an illness and an option of a medical consultation abroad.

Strategic partnerships

The PZU Group strives to create an ecosystem in which the overriding objective is to manage client relations skillfully by offering clients solutions in all venues accessible to clients. This contributes to intensifying activities in strategic partnerships with companies operating on the Polish market, among others, telecommunication operators, power utilities, retail chains and airlines, regarding joint offering of non-life and life insurance to the clients of such institutions.

Within the framework of its strategic partnerships, PZU offers a number of insurance agreements to the business partners’ clients, including:

- electronic equipment insurance and phone insurance;

- assistance insurance guaranteeing services of professionals, e.g. electrician, plumber and brown goods/white goods servicing staff, who provide help in the case of a failure in the household;

- insurance of photovoltaic installations;

- travel insurance.

In 2021, PZU cooperated with several strategic partners. Those are leaders in their respective industries and they have client bases offering the possibility of extending the PZU’s offering with additional innovative products geared towards those clients. For example, PZU cooperates with power sector companies to offer assistance services – assistance of an electrician or a plumber as well as the newly introduced health assistance. PZU’s insurance offering is also present on the e-commerce market through cooperation with PLL LOT and iSpot.

In 2021, PZU expanded its travel insurance offering. Passengers traveling abroad on board of LOT planes may take out insurance in the event they become suddenly ill with COVID-19. The policy is valid for trips not exceeding 30 days and covers all mutations of the illness. In case of a COVID-19 infection, the insurer will cover treatment costs and will pay out a benefit for a hospital stay. The insurance also covers luggage, which in such cases was frequently left without protection at an airport or a hotel. The policy also covers a situation, in which the traveler must cancel the flight due to a COVID-19 infection or a quarantine. In such a case, PZU will cover the costs already incurred in connection with the planned trip. The insurance covering sudden COVID-19 infection or the quarantine obligation is available for all connection in LOT’s offer, excluding the destinations, which due to the epidemic situation will be identified by the Ministry of Foreign Affairs as not recommended for travel, except for necessary cases. The policy may be purchased together with the plane ticket or at a later date, by managing the ticket booking on lot.com.

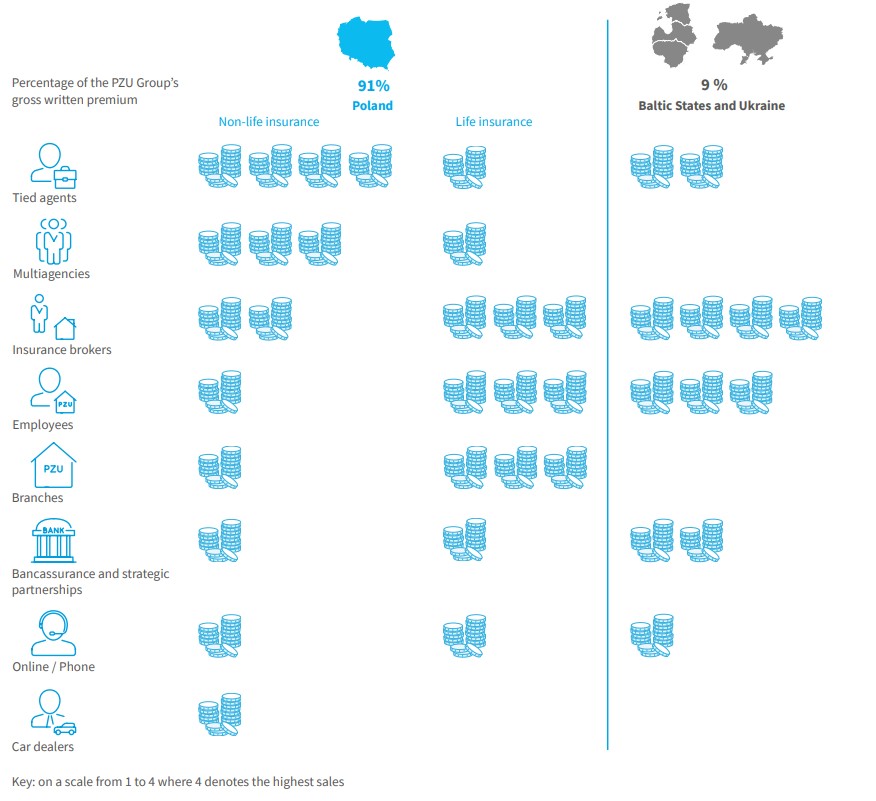

Claims and benefits handling

Claims handling is for the client the moment when they check the quality of their product. Satisfying client expectations during the claim handling or case handling process is the key to building PZU’s client relationships.

The online service for reporting claims and benefits zgloszenie.pzu.pl/ makes it possible to automatically calculate the claim amount and report a claim for foreign partners. The service upholds its emphasis on simple communication language and was awarded the “Simple Polish Language Certificate” by the Institute of Plain Polish at the University of Wrocław.

In Poland, claims and benefits handling is carried out in competence centers operating across the country. It is founded predominantly on electronic information and is not tied to the insured’s place of residence or the place of the event. The competence centers handle specific types of damage, which is conducive to stricter specialization and boosts client satisfaction. These units specialize, without limitation, in handling claims arising from property, motor or personal damage, claims reported by corporate clients, benefits, damage involving in the theft of personal vehicles or claims handled as part of the direct claims handling (DCH) service. A separate unit deals with technical issues related to claims arising from motor or property damage.

In connection with the COVID-19 pandemic, in 2020 most of the claims handling staff was offered an opportunity to work remotely, which secured the continuity of the claims and benefits handling.

In 2021, PZU also launched an alternative way to help customers outside of Poland while bypassing intermediaries. PZU Pomoc organized road assistance through Polish-speaking service providers; the service was available throughout the year in selected parts of Germany and during holidays additionally in Croatia. Moreover, a new combined transport model has been developed for long-distance international towing orders, in order to reduce their costs, and an additional partner has been engaged specializing in the provision of hotel and taxi services in the territory of the European Union. In Poland, a service provider network for trucks has been created from scratch and a unified, attractive price list has been developed for these services. The first Truck Assistance policies have already been serviced.

PZU has a Relationship Manager who stays in contact with the injured party for the duration of the claims or benefits handling process. That person’s assignment is not only to collect the documents needed to take care of the case, but also to convey information to the client about the stage of handling the process.

PZU was the pioneer in DCH (Direct Claims Handling) on the Polish insurance market. Currently, DCH is executed in two forms: at an individual level or under the agreement worked out by Polish Chamber of Insurance (PIU). DCH is offered by entities accounting for nearly 70% of the motor TPL insurance market, as measured by gross written premium. The said agreement, which is based on a lump-sum approach, has dramatically simplified the settlement of claim payments between insurers. Thanks to DCH the claim handling following an accident is carried out by the insurer from whom the TPL policy has been purchased. It subsequently makes a settlement with the perpetrator’s insurer, without the client’s participation. PZU also maintained its own DCH solution previously introduced for clients injured by insureds in companies that are not part of agreement.

PZU cooperates with repair shops in the area of post-accident vehicle repairs in countries covered by the PZU Group’s insurance business. PZU has created Poland’s largest network of cooperating repair shops enabling the Company to control the quality and speed of service already at the claim handling stage. Every client who orders a repair in the PZU Pomoc Repair Network receives a quality certificate ensuring that the repair has been performed in accordance with the highest standards.

In connection with the COVID-19 pandemic PZU launched a new service standard in the Repair Network – door to door service, i.e. collection and delivery of the vehicle to the client. Thanks to this solution the client could have their vehicle repaired without leaving home. PZU additionally continued the procedure of disinfecting a vehicle after repair by a Repair Network workshop before it is released to the customer. The success of the customer focus is confirmed by customer satisfaction surveys, in which the satisfaction of customers using Repair Networks is at 95%.

LINK4 also takes advantage of the PZU Repair Network. In order to improve service, a tool has been implemented to support the process of referring clients to the cooperating workshops. The dedicated search engine uses pre-defined business rules to select the optimum partner workshop, taking account of customer preferences, distances and repair costs. Additionally, in 2021 LINK4 carried out tests Tactable artificial intelligence-based costing tools.

In 2021, a road assistance monitoring system was optimized and implemented across Poland. Service providers gained access to the MASA (Assistance Network Activity Monitoring) application through which they receive orders, can take photos of the incident site, which are then automatically uploaded, and immediately get in contact with the hotline by pressing a button in the application. In 2021, the service of PZU Auto Szyba cover was transferred to PZU Pomoc, in order to add glass suppliers to the workshops cooperating with the Repair Network.

In April 2021, PZU restarted the campaign named “Bicycle instead of a replacement car”. Under this program, clients who get into an accident and the necessary repairs last 7 days or more, may choose from a replacement vehicle, for the time of the repair, or a bicycle to keep. The program is to promote a healthy lifestyle, care for the natural environment and reduce emissions of exhaust fumes.

PZU is developing its proposal to assist clients in managing damage remains. Clients may sell them on the Online Assistance platform to the highest bidder, where bidders are credible entities cooperating permanently with the administrator of the platform. LINK4 also takes advantage of PZU Group’s solutions and the potential of the vehicle remains sales platform (PPO) as well as field inspections and the moto-assistance service (PZU Pomoc). Under the latter service, LINK4 has been providing towing services for all incident participants since 2021.

New claims and benefits handling technologies

PZU develops new methods for determining the extent of the loss to expedite the calculation of the indemnity amount. In non-life insurance, on top of conducting a vehicle inspection in a fixed inspection point, through a Mobile Motor Expert in a venue chosen by a client or in a Repair Network workshop, the quantum of the loss may be determined under:

- simplified service procedure (without conducting a vehicle inspection);

- self-service (calculation of the amount of the loss on your own);

- video inspection (using an app to determine the amount of the loss).

The new forms of determining the extent of a loss are gaining popularity among clients.

PZU supports handling the entire claims handling process with the use of a smartphone. Using a smartphone, the injured party may:

- report a claim;

- summon assistance on the roadside or from home;

- initiate the repair process in a Repair Network workshop;

- conduct a video inspection and determine the amount of the loss.

PZU deals only with the final stage in the claims handling process, i.e. determining the amount of the indemnity and disbursement.

In addition, PZU has a self-service claims handling solution. In the case of ADD claims and benefits, the client personally marks the nature of their injuries on an intuitive human figure, which makes it possible to calculate the benefit amount. The client may accept or reject the proposed amount. This is the only solution of this type on the market for handling ADD claims and benefits.

In motor and property damage and in centers repairing devices damaged by a power surge, the client may also assess on his or her own the amount of indemnification payable. This information is then forwarded online to the Relationship Manager who executes the payment. This service allows clients to participate in the payout decision in a simple and convenient manner and reduces the waiting time for the disbursement of the benefit. Satisfaction surveys carried out among PZU clients reveal the fact that insureds are of a very favorable opinion about this service. PZU companies in the Baltic States are rolling out similar improvements. Since 2019, automatic death benefits payments are made. The payments are approved by automated processes, which considerably speeds up the handling process of those cases.

In 2021, PZU continued the ADD video assessment service, in which medical examinations are carried out using a video call. The organization of the process if based fully on PZU Group’s resources. The examination takes place in the place where the client stays, without having to leave home. The service is intuitive and very convenient – all the client needs is a device with Internet access. The solution worked perfectly well especially during the restrictions related to the COVID-19 pandemic. Moreover, PZU reduced the scope of documents required from clients. This is another initiative which made it possible to continue providing the services during the pandemic and, additionally it had positive impact on client satisfaction.

In connection with the COVID-19 pandemic, remote inspections were the preferred form of determining the indemnification amount. If the client could not use the video inspection service the claim was handled on the basis of photographs sent by the client.

In addition, PZU introduced robotics elements at the stage of summarizing the claims notification, sending out correspondence, making the claims decision and downloading police memos in order to speed up the indemnification payout. Robotics is used in specific claim types, e.g.: motor claims, mass claims caused by weather phenomena, and handling of medical and life claims (deaths and births).

The Repair Network workshops apply an innovative technology using artificial intelligence algorithms and allows for analyzing the photographs documenting the loss. It can also determine the scope of the damage and classify the given part for repair or replacement. The algorithms can detect more anomalies more quickly and accurately, and confirm that all repairs are carried out in compliance with the procedures and standards adopted by PZU. In 2021, artificial intelligence analyzed over 130 thousand claims worth over PLN 1.2 billion.

In 2021, PZU Życie developed robotic handling of medical benefits launched in Q4 2020. The optical character recognition (OCR) tool reads the data from the medical documentation and transmits it to a resource operated by a robot. Then, on the basis of a learnt script, the robot automatically transfers the read data to the product system (hospitalization period and diagnosed conditions), and verifies whether the data on the information sheet from the hospital pertain to the insured. The automation of the process supports Relationship Managers in their daily work, limiting the manual operations in the system. It also facilitates retrieval of data from unstructured documents, which shortens the claims handling time and eliminates mistakes which could occur during manual data input. In late Q3/early Q4 2021, the robot’s scenario was supplemented with steps that enable it to make a decision on the case after verifying the necessary data, further automating the claims handling process for claims of this type.

Another important technology used in LINK4 is RPA (Robotic Process Automation). In 2021, LINK4 continued the improvement of the existing claims handling processes, among others through gradually increasing the number of modern tools used, i.e. robots. The robots employed by LINK4 have reduced the work time, improved efficiency significantly and allow the company to implement additional solutions to increase customer satisfaction. Among others, they support: automatic registration of motor and casualty and property claims, update of the reserve amount and entry of costs of inspections carried out by third party suppliers, verification of a vehicle’s loss ratio, collection of loss documentation, handling of memos from the Insurance Guarantee Fund, handling of medical opinions, review of vehicles with MOD insurance, the process of sharing claims files, sending claims decisions, they prepare payouts in the Direct Claims Handling process, collecting the documentation of inspections from the platforms used by the company. Thanks to RPA it was also possible to create document repositories, which significantly facilitated documentation access and management, especially in the remote work formula. In 2021, LINK4 also developed competencies in other technologies that enable process automation, such as VBA and Power Apps.