Strategy 2021-2024 [IIRC]

On 25 March 2021, the PZU Group announced its new Strategy “Potential and Growth”, which identifies the opportunities and points to the main strategic ambitions of the PZU Group for the years 2021-2024. The strategic assumptions refer directly to customer needs, personalization and flexibility of the offer, and embedding of these requirements in specially created ecosystems. In order to achieve these goals, modern business models will be implemented while maintaining the principles of sustainable development, taking care of the natural environment, better quality of life for employees and clients, and involvement for the development of local communities. This area will be supported by the implementation of new technologies, innovation and further digitalization, which will allow us to better understand and satisfy the client’s needs in the shortest possible time using their preferred contact channels.

PZU Group Strategy in 2021-2024 sets out 4 main areas of ambition, in which the directions were set for strategic measures.

Area 1 -Stable dividend and growing gross written premium and revenue

- Maintaining growth in key business areas

Insurance – kept the leading position and increased gross written premiums to PLN 26 billion, i.e. by 10%.

Health – the fastest-growing company on the health care market; PZU Zdrowie increased its revenues to PLN 1.7 billion, i.e. by 80%..

Investments – increased assets under management to PLN 60 billion, i.e. by 82%.

Banks – Alior Bank and Bank Pekao increased their contribution to the Group’s financial results to PLN 0.8 billion, i.e. by nearly 650%.

- Maintaining cost discipline

The PZU Group plans to maintain its cost effectiveness in the post-pandemic period by applying cost discipline, investing in digitization and digitalization, and by changing its work model to remote or hybrid working. The goal is to reduce the administrative expense ratio by 0.1 p.p. in 2024.

- Bolstering the potential to generate a high level of net profit

By harnessing consistent measures carried out on all the markets where the PZU Group is present, at the end of 2024 it will be possible to generate the highest net result since the time when PZU went public of roughly PLN 3.4 billion. This signifies an increase of approximately 79% versus 2020.

- Delivering high business profitability

Maintaining and improving high profitability of business is an important part of the Group Strategy. Despite the negative effect of the COVID-19 pandemic, the PZU Group plans to increase its return on equity (ROE) to 17.4% by 2024. This goal will be achieved as a result of a safe and sound business model predicated on business diversification, further streamlining of business, product and distribution processes.

- Maintaining an attractive dividend policy

The PZU Group intends to generate above-average profits, which it plans to pay out annually in the form of a dividend. It will amount from 50% to 100% of the consolidated annual profits.

Area 2 – Leveraging the PZU Group’s potential

- Effective utilization of databases and knowledge of clients

The PZU Group plans to use knowledge about its clients even more effectively. It will enable the Group to develop a top-quality offering responding to real client needs. By harnessing the potential of databases, it will be possible to personalize the offering, as well as provide coordinated care of relationship managers at each stage of the process and acquire new clients. The Group’s strategic activities assume: harmonizing access to information sources and channels, rolling out analytical tools for machine learning and artificial intelligence, and incorporating them in our business processes.

- Development of business collaboration with banks and strategic partners

Together with Bank Pekao and Alior Bank, the PZU Group wants to achieve cumulative gross written premium of about PLN 3 billion, by reaching the banks’ clients with a comprehensive and unique offer of combined insurance and banking products. It plans to broaden the PZU Cash offer, strengthen the insurance position on the energy market and develop cooperation with Strategic partners operating on the e-commerce market.

- Utilization of all distribution channels

Through an omnichannel approach, the PZU Group will be able to reach clients through various distribution channels suited to their needs and preferences. Clients will receive access to a broad range of modern products, including life and non-life insurance as well as health, investment and banking products customized to their evolving needs at every stage of their life.

- New approach to health care in Poland

The PZU Group plans to emphasize building health awareness and preventing diseases. The offering will include top quality personalized medical care services. By achieving these goals while keeping the business profitable, the Group will grow faster than the market and earn the leading position on the private health care market.

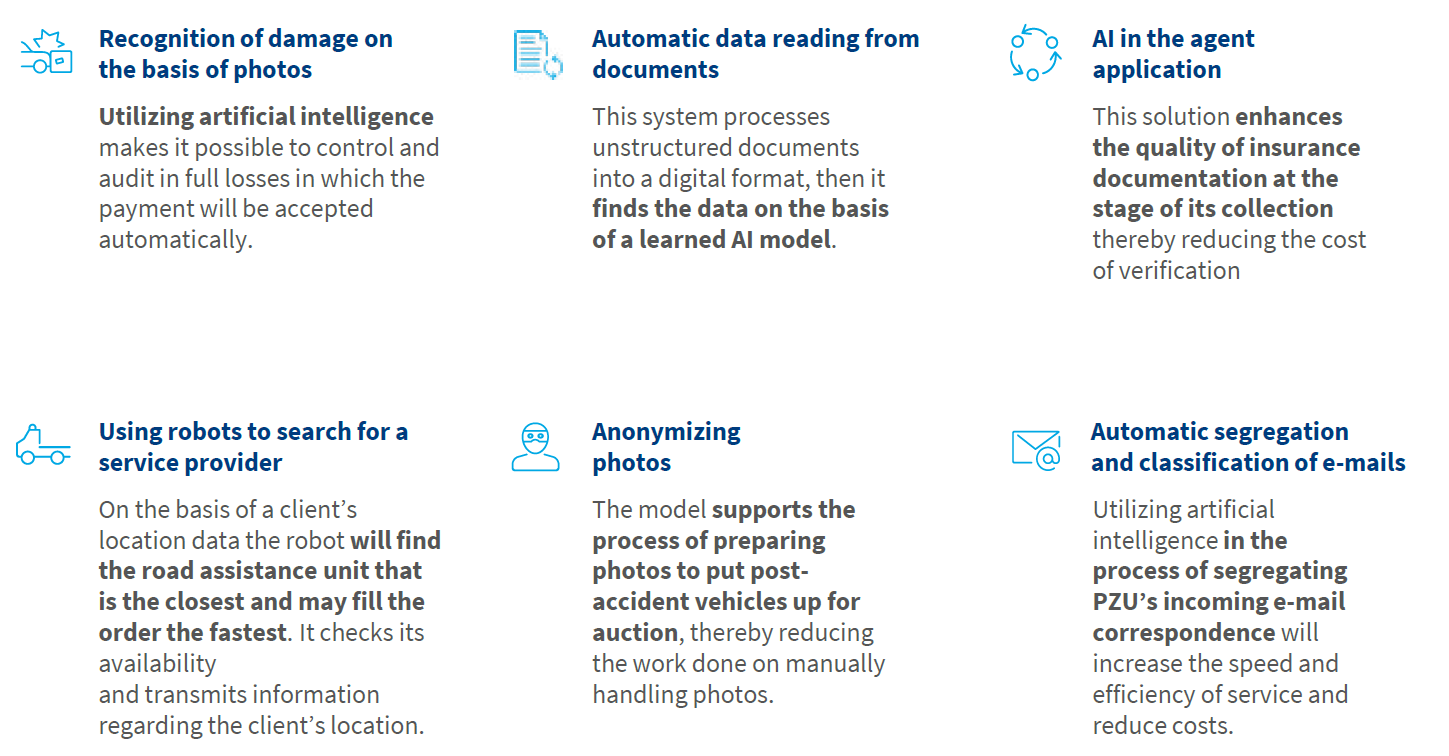

- Introduction of a modern claims and benefits handling process using new technologies to automate and accelerate processes and reduce costs

Area 3 – Innovative financial group

The PZU Group plans to leverage the latest technologies in all areas of its activities:

- digitalization and streamlining of processes – we continue to implement solutions for clients that are simple, intuitive and universal;

- use of AI, Big Data and advanced analytics – implementation of new technologies should lead to improved operating efficiency and profitability of business, among others through automation and streamlining of decision-making processes;

- mobility and omnichannel approach – utilization of new digital distributions channels to supplement the traditional ones;

- cloud computing – support for technological transformation, including greater efficiency of the infrastructure;

- cybersecurity – protection of our IT networks; introduction of tools for estimating cybersecurity risk in the financial sector.

Area 4 – Sustainable growth

The PZU Group will build its success based on contemporary business models, which include elements of sustainability. It will become an active participant in safe and responsible transition processes. The sales offering will be extended to include green products. Support for social initiatives is also planned, to be aimed at, among others, environmental protection as well as promotion of safety and a sustainable lifestyle. It will be PZU Group’s priority to always act transparently, relying on clearly defined ESG criteria.

ESG management in the PZU Group

In order to highlight the importance of the ESG aspects and capture them in business terms, the key performance indicators of the ESG Strategy have become an integral part of the PZU Group’s strategy. The Group’s companies have implemented selected elements of the ESG strategy, adapting them to the specific context of their respective operations.

To achieve efficient ESG management, the Sustainable Development Department was set up by the end of 2020, with the function of coordinating all actions in the area of the ESG Strategy implementation. The Director of the Department reports directly to a Management Board Member of PZU Życie.

In 2021, the ESG Committee was appointed. Its composition comprises representatives of the management boards of PZU, PZU Życie, PZU TFI, TUW PZUW, PZU PTE, as well as directors of the organizations’ key departments. The detailed principles of the ESG strategy implementation and cooperation among the Companies in this respect have been defined in the internal Sustainable Development Policy. The Sustainable Development Policy in the PZU Group lays down the basic principles of conducting the PZU Group’s business responsibly, while taking into consideration environmental, social and governance factors. It also defines the principles of cooperation and information exchange in this area in the PZU Group.

PZU Group ESG Committee

Purpose

To define consistent ESG actions in line with the PZU Group strategy

Tasks

- supervision over the consistency of ESG activities with the PZU Group’s business objectives;

- setting out general sustainability guidelines in the PZU Group;

- building recognizability of the ESG Strategy inside and outside the PZU Group;

- making recommendations on the implementation of the idea of sustainable development into the business practices of the Companies, and integrating business processes with ESG objectives, as defined in the ESG Strategy;

- monitoring, providing opinions on and reviewing the implementation progress of the ESG strategy;

- participation in the development and updating of the ESG Strategy;

- giving opinions on actions, plans and projects connected with the ESG Strategy implemented in the PZU Group and presenting these opinions to the relevant governance bodies of the Companies;

- giving opinions on the methods and directions of adapting the principles of the Companies’ business activity to ESG regulatory and reporting requirements.

Composition

President and Members of the Management Board of PZU, President and Members of the Management Board of PZU Życie, President of the Management Board of TUW PZUW, President of the Management Board of TFI PZU, President of the Management Board of PTE PZU, and in PZU and PZU Życie: Managing Directors, Director of the Corporate Communications Department, Director for Investor Relations, Director of the Sustainable Development Department.

ESG Strategy of the PZU Group [IIRC]

The “Balanced Growth” ESG Strategy for 2021-2024 defines the primary objectives that should ensure sustainable development of the PZU Group. By the way of developing innovative products, services and partnerships, PZU wishes to become an active leader in the implementation of Agenda 2030. To this aim, PZU has defined Sustainable Development Goals that it can have the best impact on, and included them in the fundamental assumptions of its ESG Strategy.

In 2015, 193 UN members states adopted a plan for a transformation of the world and improving the life of every human being on the planet - the Sustainable Development Agenda. The Agenda 2030 sets out 17 Sustainable Development Goals and 169 targets to be achieved, which clearly specify the actions to be taken to ensure than every person can use the fruits of this development. The Global Goals are pursued by all the stakeholders: governments, the world of science and research, society, as well as business.

The Sustainable Development Goals are the largest global corporate undertaking. Enterprises integrate into their strategies and actions the universal values and principles in respect of human rights, work, environment and ethics. By subscribing to the sustainable development goals, business can join into sharing the responsibility and contribute to building of a better world.

Investment strategy

Governance policies and systems in the PZU Group [Accounting Act]

Investment process

For every product managed by TFI:

- investment funds and asset portfolios for external clients;

- investment funds dedicated to the PZU Group;

- asset portfolios of the PZU Group;

within the scope of the legal remit and investment strategy of each fund or product, TFI takes investment decisions based on a comprehensive analysis of financial instrument issuers and their environment. These analyses cover the full spectrum of factors with an impact on the value, including risks to sustainable development. In the investment process, these risks are considered, inter alia, in financial, regulatory and legal analysis, as well as the level of entire instrument portfolio management. In 2021, TFI has developed and implemented methodologies for the individual classes of assets::

- securities issued, guaranteed or secured by governments;

- securities issued by corporate issuers, admitted to public trading;

- securities issued by corporate issuers, not admitted to public trading;

- real properties;

- investment funds.

TFI PZU conducts analyses of the funds invested into individual asset classes based on methodologies selected for each class.

Strategy of exercising voting rights from financial instruments

Guided by the interests of participants in the investment funds it manages and clients to whom it provides portfolio management services, TFI PZU follows its “Strategy of exercising voting rights from financial instruments in the investment portfolios managed by TFI PZU”. The company’s fundamental duties ensuing from its strategy are as follows:

- monitoring material events in the companies identified in the strategy;

- ensuring that voting rights are exercised in accordance with the investment objectives and investment policy of the respective fund;

- preventing conflicts of interest following from exercising voting rights and managing companies.

TFI PZU actively participates in the corporate governance development process in its portfolio companies, by participating in their shareholder meetings and pursuing the goal of protection and creation of investment value for fund participants and its clients. Bearing in mind the remaining provisions of the strategy, TFI PZU espouses the principle that it strives to participate and actively vote in all shareholder meetings of companies in which it has, on behalf of its funds or clients, the right to exercise more than 5% of the total number of votes.

TFI PZU has adopted principles that guide its choices when voting at shareholder meetings of companies included in its mutual fund portfolios or investment portfolios. The rules contemplate among others active voting on matters related to social and environmental issues as well as corporate governance issues. Additionally, they include provisions encouraging stringent corporate governance standards, in particular those that advance transparency, equal treatment of shareholders, independent oversight and the responsibility of shareholders and members of corporate authorities.

The Code of Best Practices of Institutional Investors prepared and approved by the Chamber of Fund and Asset Management has been in force in TFI PZU since 2006. For TFI PZU, the Code provides a great deal of support in defining the rules, moral and ethical standards and due diligence levels in the company’s relationships with other institutional investors, clients and issuers of financial instruments. The adoption of this code also confirms the application of best investment practices in TFI PZU.

In 2014, the Management Board of TFI PZU adopted a resolution to adopt the “Corporate governance rules for regulated institutions” issued by the Polish Financial Supervision Authority (KNF) in which the Management Board declared its readiness and will to abide by these rules to the objectively broadest possible extent, taking into account the principle of proportionality resulting from the scale, nature of business and specific characteristics of TFI PZU. The rules are a collection of standards that define the internal and external relations of regulated institutions, including their relations with shareholders and customers, their organization, the functioning of internal oversight and key internal systems and functions as well as the governing bodies and the rules for their cooperation. According to the contents of this document, TFI PZU provides on its website information on the application or non-application of specific principles addressed to the Management Board and Supervisory Board.

TFI PZU employs managers holding the CFA designation who are bound by a code of ethics and standards of professional conduct. In their professional contacts with the public, clients, prospective clients, employers, employees, colleagues in the investment profession, and other participants in the global capital markets, members of the CFA Institute act with integrity, competence, diligence, respect and in an ethical manner. They also promote the fairness and vibrance of capital markets to obtain the greatest social benefits.

TFI PZU also employs investment advisers who are guided in their work by the standards laid down in the Professional Ethics Principles for Brokers and Advisers.

Incorporating ESG issues in voting strategy

Guided by the interests of participants in the investment funds it manages and clients to whom it provides portfolio management services, TFI PZU follows its “Strategy of exercising voting rights from financial instruments in the investment portfolios managed by TFI PZU”. The voting strategy lays down the rules by which TFI PZU is guided when choosing how to vote at shareholder meetings of companies in its mutual fund portfolios or investment portfolios.

As of March 2020, these rules include environmental, social and governance issues. In accordance with them, TFI PZU:

- will actively vote on matters related to social and environmental issues as well as governance issues;

- will endorse the application of high corporate governance standards, in particular those that advance transparency, equal treatment of shareholders, independent oversight and the responsibility of shareholders and members of corporate authorities;

- will endorse actions for issuers to adopt, implement and publish governance and ethical principles, standards and procedures spanning the issuer’s management board, supervisory board and employees.

These practices serve the interests of members of funds and portfolio clients, grow the value of investments while simultaneously respecting environmental and CSR issues and building high standards of corporate governance.

Incorporating ESG risks when monitoring publicly-traded companies in which investments have been made

TFI PZU, bearing in mind the interests of participants in the funds it manages is guided by the “Exposure policy of mutual funds managed by TFI PZU SA to companies listed on the regulated market”. This policy was adopted in April 2020.

The policy describes how shareholders’ exposure to companies listed on the regulated market is taken into account in the fund’s investment strategy.

Actions related to funds’ exposure to issuers’ equities in which an investment has been made include, among others, monitoring issuers in terms of the investment risk with an eye to social and environmental impact and the corporate governance principles followed constituting selected aspects of the socially responsible investing process.

The research process is conducted in such a way so as to facilitate deliberate and responsible investment decision-making.

These practices serve the interests of members of funds, grow the value of investments while simultaneously respecting environmental and CSR issues and building corporate governance. The purpose of this action is ensuring that investment decisions are made in accordance with the investment objectives and investment policy of the respective funds

Innovation strategy

Digitalization is a process that has come to stay and is constantly developing in all sectors of both the global economy and our domestic economy. Investing in digital solutions generates a number of benefits not only for companies, their staff and their business partners but also for their clients. Clients expect more and more personalized products, are aware of the risks arising from cybercrime and personal data management issues. The emergence of new entrants and trends associated with development of new technologies, including operators of big databases, insurtechs and fintechs1, increasingly drives changes in the insurance and banking sectors. In similar fashion, the MedTech and HealthTech2 solutions market is developing faster than ever before.

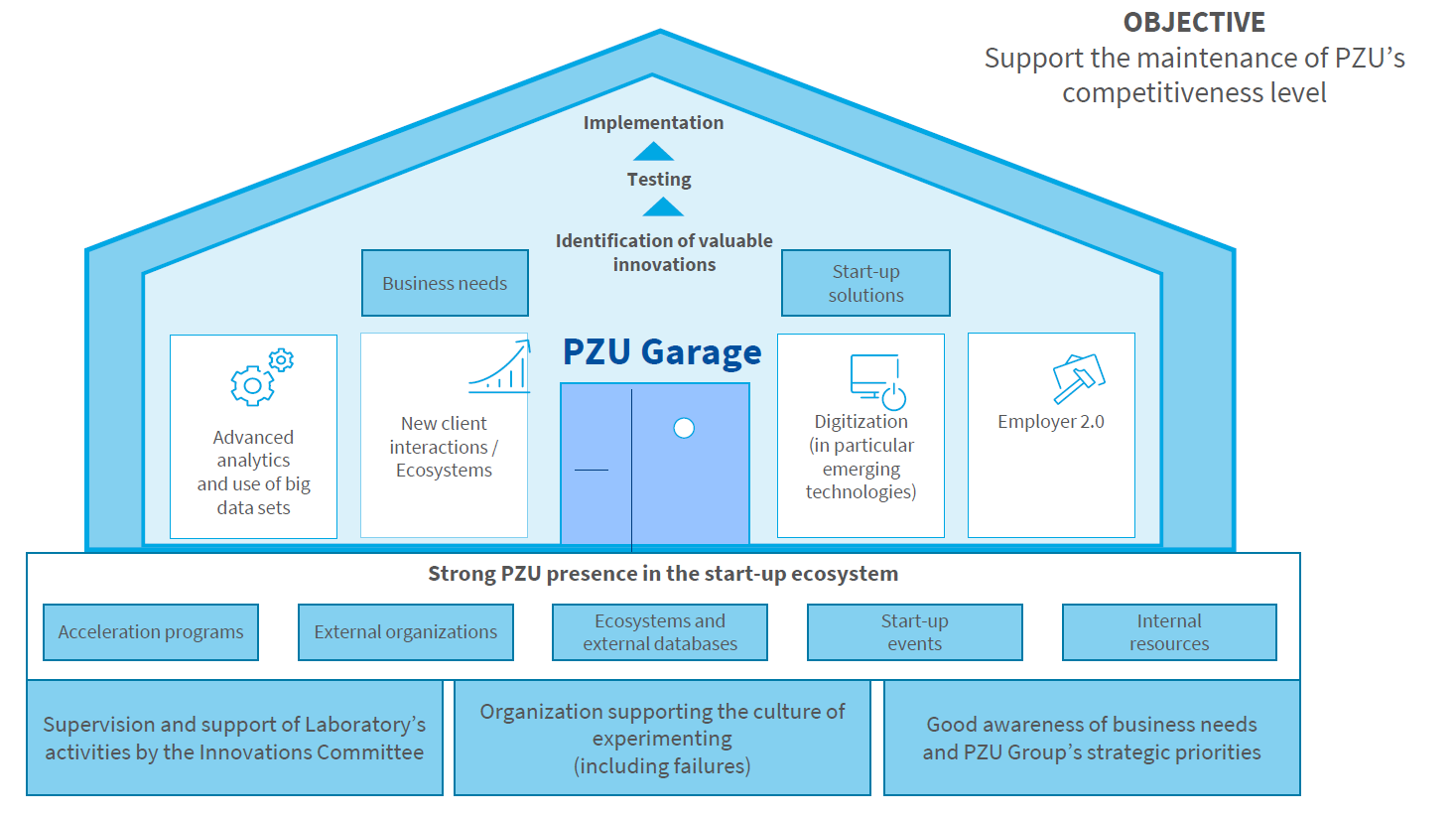

Innovation is one of the key values for the PZU Group. Innovation thinking outside the box, breaking molds and looking for opportunities to streamline functioning of the company.

Innovation in the PZU Group is not limited to a single division, project or area. Smaller and greater changes are constantly being made to every aspect of how the firm operates, and they combine to form a picture of one of the most innovative companies in the financial industry in Europe. PZU’s innovations contribute to client satisfaction, which is a top priority for the Group, and to employee comfort, and at a micro scale, to the development of the overall economy.

PZU Ready for Startups 2024

Innovation strategy

The innovation strategy adopted by PZU in supports the pursuit of the overall PZU Group’s mission and strategy. Four major areas are set forth thereunder, in which particular effort is expended to find new solutions:

- Advanced analytics and using big data sets;

- New client interactions Ecosystems;

- Digitalization (in particular emerging technologies);

- Employer 2.0.

The innovation strategy is reflected in the projects and initiatives executed by PZU. The Group is fully aware that innovations call for making creative space conducive to generation of ideas, as well as prototyping, testing and implementing unique original solutions. This is the role of PZU’s Innovation Lab. Its overarching task is to search for modern solutions, check them, perform tests and support rollouts. Moreover, special processes have been forged in the entire organization to facilitate rapid testing and implementation of innovative solutions. In 2021, nearly 1,000 start-ups and ideas were analyzed; and 12 pilots were carried out. During the year, 7 projects were advanced to the implementation phase. Over the past four years, PZU has been awarded over a dozen industry prizes, including in 2021: two commendations in the Rzeczpospolita Daily’s Eagle of Innovation Contest (Orzeł Innowacji Rzeczpospolitej) - for the projects: Cyber SME and Semantic OCR; a commendation in the Wprost Weekly’s Innovators contest (Innowatory Wprost) - for the project: Cyber SME), and the Banking Gazette Leader award - for the project: Semantic OCR.

The COVID-19 pandemic has significantly accelerated many processes making use of new technologies. The lockdown of the economy and the restrictions imposed in 2020 and continued in 2021 forced the transition to distance work and significantly affected how the financial institutions provide their services to clients. These factors increased the rate of digitalization and the use of advanced technologies, especially in the insurance sector. Remote forms of sale, inspection and claims handling became popular relatively rapidly. Digitalization has also made strides in health care, with the growing role of telemedicine which has become an indispensable element of medical service provision during the pandemic.

In 2020, PZU Group earmarked over PLN 210 million for projects activities3. In 2021, financial expenditures amounted to PLN 137 million, with the largest share – over PLN 84 million spent by PZU and PZU Życie.

In PZU, the Idea Generator has been operating under the auspices of the Innovation Lab. It is an internet portal where the PZU employees may submit their ideas for innovative solutions. New editions of the competition for the best ideas on a specific topic are regularly announced. In 2021, the Idea Generator provided ideas for business initiatives that would support the implementation of selected Sustainable Development Goals - the “SDG (Sustainable Development Goals) Challenge 2021, or how can PZU support sustainable development?” contest.

Every portal user is able to not only submit the ideas but also vote for his/her favorite ideas and post comments. Three best ideas from each edition will receive financial prizes, and their authors will have the opportunity to get involved in the implementation of the proposed solution. From the beginning of the Generator, in 9 editions, nearly 600 ideas for internal improvements and brand-new innovative solutions were submitted.

Acceleration program

In 2021, PZU became a partner in the Poland Prize acceleration program funded by the Polish Agency for Enterprise Development. The accelerator supported by PZU operates under the patronage of the Massachusetts Institute of Technology (MIT) – a renowned research center which for many years has been actively supporting young companies in their development and expansion to new markets, and it has been setting the direction for discourse and development of the entire modern technologies industry.

Poland Prize is a project that supports foreign startups in entering the Polish market thanks to grants, an acceleration program and the possibility to start pilot cooperation with partners such as PZU.

As part of the cooperation and the first edition of the program taking place in 2021, PZU gained access to about 250 technological startups from all over the world, from which, following a selection process, a series of dozens of interviews and workshops, two were ultimately chosen for cooperation under the program. Two more editions of the program are planned for 2022.

For startups, participation in the accelerator offers a number of benefits - including business model development, expert support (e.g. legal), expanding the network of industry contacts in Poland and abroad, but most importantly the opportunity to work with leading corporations and jointly test the startup’s solutions in real market conditions as part of pilot projects.

PZU began working with the startups in partnership with the accelerators in 2018.

Innovation of the PZU Group’s product and service offering

Analytical activities of the Innovation Lab

In March 2021, the PZU Innovation Lab prepared the #PZUReadyForStartups report, which analyzed the situation of the Insurtech scene in Poland and worldwide, and presented PZU's offer for startups under the #PZUReadyForStartups program. Thanks to the published report, in Polish and English language versions, Polish and foreign startups could broaden their knowledge on innovative initiatives taking place in PZU and learn about the needs of the largest insurer, which they can try to address with their solutions. By publishing the report, PZU is able to more effectively reach the startup ecosystem and invite the most promising, innovative companies from Poland and abroad to cooperate. The report was premiered during the "Insurtech Day powered by PZU" event, to which 8 foreign insurtech and medtech startups and representatives of the Polish startup ecosystem were invited.

In November 2021, PZU became a partner of the "Insurtechs in Poland" report published by the industry portal Cashless. As part of the report, PZU and its partners have carried out a cross-sectional review of the Insurtech market, selecting and describing all relevant Insurtech startups in Poland. By co-publishing the report, PZU presented itself as a leader in cooperation with the insurtech industry, recalled its #PZUReadyForStartups program for startups, and had the opportunity to establish further relationships with valuable players supporting insurers' digital transformation.

Innovations in subsidiaries

In Bank Pekao, the unit responsible for creating an innovation culture, accelerating the implementation of innovative solutions and cooperating with fintechs, startups and technology companies is the Innovation Lab. In its activities, the Lab focuses especially on innovations that support building modern banking and tailoring products and services to client expectations. The Innovation Lab draws on both market and non-market practices, as well as trend research, crowdsourced ideas, and technologies provided by young companies. In 2021, Bank Pekao, together with Huge Tech, launched a selection process for startups and technology companies to join the Idea Global gas accelerator.

Alior Bank has an internal structure – RBL_ Innovation by Alior Bank, whose task is to develop the bank’s innovation potential. It is composed of:

- Innovation Lab, responsible for prototyping, UX tests and service design;

- Open Banking team responsible for compliance of the services provided by OpenAPI with the requirements of the PSD2 regulation, provision of Open Banking services based on APIs of other banks (Alior as a TPP) and development of commercial APIs beyond PSD2 requirements;

- Fintech Partnership Team, which supports the development of the bank’s external innovation ecosystem;

- Strategic Partnerships Department, which manages partnerships and projects with large entities and public institutions, among others, responsible for operational functioning of the Cash portal together with a PZU Group company – PZU Cash. The unit also coordinates pilot projects in the bank, both formally and operationally.

Furthermore, Alior Bank has a separate Corporate Venture Capital Fund - RBL_VC, operating in the form of an Alternative Investment Company (ASI), whose task is to invest in innovative projects, in particular those supporting the implementation of the strategy of the Bank or PZU Group entities.

Selected innovations in the PZU Group:

Insurance area

- Robotics

Robotics is a tool that allows full automation of tedious and repetitive tasks that do not require any sophisticated specialist knowledge or experience. Robots enable replacement of cross-system integration and process large volumes of data in a very short time. The use of Robotic Process Automation (RPA) technology improves data quality, streamlines process efficiency control and provides an additional reporting conduit. The application of robotics makes it possible to carry out processes that until recently could not be executed by employees due to their high labor intensity or the need to perform complex operations in a short time.

The deployment of a robotic process takes less time than implementing a systemic change, and the solution itself generates lower costs than would be required if additional employees were to be hired.

In 2021, 24 business processes were implemented in the robotics team, 18 of which were in the claims handling area. In addition to development of new processes, more attention than in previous years was given to expansion of the existing scenarios. For optimization purposes, some new business processes were integrated into already implemented robotic activities.

As of early 2021, 2 processes have been implemented in claims handling using a smart OCR solution - handling of death and birth cases. As part of these processes, the iOCR reads information about the persons involved from registry records and ID cards, then passes the information to a robot which, having verified the remaining conditions in the case, pays out the benefit. In the second half of 2021, automatic indemnification payout functionality was implemented in the hospital treatment benefits handling process.

The RPA technology has been used to support a pilot of the Routing project, where a robot transfers data between the claims system, the artificial intelligence module and the user application.

In addition, thanks to robotics, we have automated the retrieval of information necessary for claims handling from external sources such as: Insurance Indemnity Fund, Audahistory database or Police Notes.

The average annual number of operations processed by the robot increased from 7 to 11 million. The processes implemented in 2021 generate annual savings of approx. PLN 6.8 million. Process efficiencies are as follows:

- Robots are responsible for comprehensive handling of approximately 42% of child birth benefits.

- On average, 8% of hospital treatment benefits are paid by robots.

- In 2021, robots verified the occurrence of double insurance in claims more than 0.9 million times using integration with the Insurance Indemnity Fund. Thanks to the high efficiency of the solution, events from earlier years are verified with the help of robots.

- Audahistory's prior damage report is attached to an average of 4,000 motor claims per year.

- Cooperation with the Artificial Intelligence Factory helped identify 378 claims with control strips in the crops, allowing further analysis for claims fraud.

In 2022, further development of the robotics platform is planned through:

- automation of claims handling, including: combining events, payouts in new types of cases, sending decisions in cases without coverage;

- using RPA to verify the potential and viability of integration with new tools, such as voicebot;

- adaptation of processes to system changes caused by personal data retention regulations.

- A robot that supports the work of Relationship Managers in selecting claims with subrogation potential.

In October 2021, the Claims Handling and Remote Channels Division introduced a robotization process supporting the work of Relationship Managers in selecting claims with subrogation potential. The goal of the process is to identify claims as potential subrogation claims at the earliest possible stage of the claim handling process. The robot runs on a specially designed control file, in which, on the basis of experience and analysis of the past few years, the so-called keywords (words that qualify and exclude a claim from the process) have been identified, which prove or may prove that there is a potential for subrogation in the claim. The robot searches for the selected keywords in 3 places, having their source in SLS: description of circumstances, operator's commentary and name of the cause of damage. If the robot finds one of the keywords it performs a series of actions in SLS:

- It flags the information status as ‘potential subrogation’ and ‘robot subrogation’ - securing control of the claim with a subrogation potential;

- It attaches to the claim in the supporting materials the so-called subrogation scenario, i.e. a form to be filled in, which is an instruction for the Relationship Manager as to what actions should be performed in the claim in order to secure subrogation claims;

- It adds instructions for the Relationship Manager to assess whether the damage selected by the robot has subrogation potential and to execute a subrogation scenario - for these actions the Relationship Manager has 21 business days, but no longer than until the day of issuing a decision in the claim.

If, on the other hand, the robot finds keywords contained in the control file that are flagged as excluding subrogation potential, then it abandons the above actions, because the assumption is that these words indicate that there is no subrogation potential in the claim. The implemented process supporting the work of Relationship Manager is to increase the number of selected subrogation claims and, what is equally important, improve the issue of proper protection of subrogation claims by obtaining documents and information necessary to effectively pursue subrogation claims at the stage of handling the claim.

- Artificial intelligence (AI) in claims handling

PZU as a leader of digital transformation constantly works on innovations increasing customer service quality. AI in claims handling is a solution utilizing artificial intelligence, analyzing damage photographs and cost estimates from the car repair shops. PZU handles over 500 thousand motor claims per year. Bulk of them are handled by repair shops. Most claims comprise mass photographic and technical documentation. A lot of it requires additional in-depth analysis. These activities require trained and highly qualified experts. The implemented artificial intelligence solution has improved their daily work. The artificial intelligence algorithms implemented by PZU are able to analyze the photographs documenting a motor loss. They are also able to name a specific part of a vehicle, assess the extent of the damage and classify a part for repair or replacement. Before using artificial intelligence algorithms most cases handled by repair shops had to be analyzed manually. Thanks to implementation of this solution experts receive for analysis only selected cases while the remaining ones, which do not raise any doubts, are approved automatically or semi-automatically. The implementation translates into significant financial savings and improvement of client satisfaction.

In 2021, PZU continued and developed innovative claims handling activities using the latest technologies based on artificial intelligence to streamline the process.

PZU's mobile experts who carry out inspections of vehicles damaged in accidents have been given an AI-based tool to assist them in estimating the damage. The solution prepares a preliminary repair estimate based on the photographs of the damage taken by claims adjusters. Advanced algorithms recognize different parts of the vehicle and prepare a preliminary estimate within a few minutes.

Thanks to the new technology, platform users can handle claims reported by clients in a faster and more uniform way (one approach to cost estimation). The system verifies the extent of the damage using databases of cost estimates for repair or replacement of damaged parts and recommends the appropriate action - repair of the vehicle part in question or its replacement - and prepares a cost estimate.

In 2022, we plan further implementation of the AI-based solution at other stages of claims handling, improving our clients' experience.

- #innowacJA project

This is a program for development of PZU's culture of innovation addressed to non-life insurance sales employees in the proprietary, multiagency, broker and dealer sales channels. It serves to leverage their potential to create solutions embedded in business objectives that will tangibly reduce operating costs or increase sales. The program launched in the fall of 2019 and has already resulted in more than 500 ideas by 2021. Its leaders are Local Innovators.

The project was awarded in the competition "The best programs for developing employee initiatives" organized by the Polish Agency for Enterprise Development. The jury awarded it for systematic involvement of employees in development and innovation activities within the company.

- PZU GO

PZU GO is a state-of-the-art solution guarding the driver’s safety while behind the wheel. This small device pasted to the car’s windshield communicates with the app in the driver’s phone and detects dangers. In the event of an accident, PZU GO immediately notifies the PZU Emergency Center of its occurrence and location. PZU immediately contacts the driver to check if he or she needs any assistance. Unless the driver answers the phone, PZU notifies the emergency services and provides them with the last location obtained from the device’s GPS. The PZU GO option also includes additional benefits, such as: transporting the insured to a hospital, arranging a doctor's appointment, or delivering medicines to a specified place.

As of May 2020, PZU GO has been available throughout Poland in all sales channels. Clients with the PZU GO cover have travelled tens of millions of kilometers. In more than a dozen cases, immediate assistance was provided to the injured after the accident was automatically detected. In addition, in several hundred cases, clients received assistance having called for help via the SOS function.

- Non Stop Assistance

Non Stop Assistance is a brand owned by the PZU Group, which has been developing mobility services and products since 2020. At present, Non Stop Assistance is part of the Driver's Ecosystem and supports the development of the platform for services addressing drivers' needs for holistic vehicle care. The Driver's Ecosystem is an initiative aimed at developing new, non-insurance services supporting the development of Client relations. At present, the Driver's Ecosystem uses digital tools to provide 8 services to Customers who need support in daily use of a car.

- Remote authentication

The mojePZU portal is the most extensive platform on the insurance, financial and health market allowing to confirm identity with myID (myID) and mObywatel (mCitizen). Thanks to this functionality, clients may register on the platform remotely without the need to come to a PZU branch and confirm their identity. Its allows for secure access to medical records, among other things. It is also possible to initiate the opening of an account by a PZU representative, by providing the client with an activation link, after clicking which they will be able to complete the registration on their own. A mojePZU account can be opened by clients reporting claims and, from 2020, also by persons reporting claims under a TPL policy of a perpetrator who is not a PZU Group client.

- Cyber SME

The COVID-19 pandemic significantly accelerated the digital transformation process and forced many SME sector companies to transfer their operations online. This, in turn, exposed the companies to cybersecurity risks to greater extent than before. Therefore, PZU developed a free tool – Cyber SME which is a platform that analyzes the websites of small and medium-sized enterprises and verifies the strength of their cyber-attack safeguards. A company, which decides to take advantage of that service, will receive a free report drafted by PZU, which covers the website security, assessment of the reputation risk as well as potential attractiveness to hackers. The report will also include recommendations which, when implemented, will improve the company’s cybersecurity. The report’s formula is simple, straightforward and transparent. It was designed to be understandable not only to IT specialists.

- Self-service of claims and personal matters

Self-service was created as an element of the digital service models adopted by PZU. It is a response to the growing needs of clients who expect not only convenient online tools to report a claim intuitively but also to be provided quickly with the amount of compensation. The new solution has enabled a reduction in the time of acceptance and handling of claims. This approach worked well for clients and was especially popular during the COVID-19 pandemic.

Self-service is an element of the online reporting of a claim. Information about vehicle damages sustained during the insurable event permits automatic calculation of the proposed amount of compensation.

In the case of ADD claims and benefits, the client personally marks the nature of their injuries on an intuitive human figure, which makes it possible to calculate the benefit amount. The client may accept or reject the proposed amount..

- Cash Back

Cash Back is an innovative program where the holders of LINK4 motor insurance may generate bonuses for safe driving. The analysis of driving style includes driven distance, smoothness of driving and the area where the driver was driving. From April 2017 to December 2021, the program was utilized by more than 71 thousand LINK4 clients who drove a total of more than 192 million kilometers.

To become an active participant in the program, the client should drive his/her car with a switched-on NaviExpert navigation and the LINK4 Cash Back module for at least 200 kilometers a month, and he/she should start the app during at least 5 different days and drive at least 10 kilometers on the given day. After each monthly period, the driver is assigned with a summary grade which allows to classify him/her in a relevant profile, which in turn serves as a basis for determining the amount of the financial bonus. After one year, the LINK4 insureds may exchange the sum of those bonuses into reimbursement of up to 30 percent of the insurance premium.

Each participant decides on his/her own whether to earmark the bonus generated at the end of the agreement term for reduction of insurance price after policy renewal or whether he/she would prefer to have the funds transferred into his/her bank account.

In December 2021, the value of safe driving bonuses generated under the program exceeded PLN 4.2 million. The largest bonus amounted to PLN 1.2 thousand. However, the program’s greatest value is prevention and promotion of safe driving on Polish roads.

Banking area

- Certification of identity

Alior Bank is developing the digitalization of services currently offering several different digital methods of identity confirmation. In 2021, the bank worked to expand remote identification methods to include more identification methods and capabilities. In 2021 Alior Bank continued analytical work with Polska Wytwórnia Papierów Wartościowych, which resulted in the signing of an agreement in August 2021. Thanks to this cooperation, the Bank will be able to provide another method of verifying clients’ identity (based on the use of eDO App) without the need to visit a branch. Clients will be able to confirm their personal data with an e-card, use an advanced signature, and thus freely apply for banking products.

Bank Pekao has systematically developed the Pekao24 service and expanded the PekaoID digital identity service and the Trusted Profile, enabling remote confirmation of the identity of retail clients. Following integration with the eIDAS National Node, the numbers of PekaoID activations have surged. In addition, in 2021, Bank Pekao, implemented the possibility to open a selfie account using an e-ID.

- Remote submission of instructions, signing of agreements and opening of accounts

In 2021, the PeoPay app, Bank Pekao's main mobile banking tool, expanded to include self-service processes, enabling clients to submit applications for a housing loan, student loan, cash loan, account or card on their own without leaving home, including an application for a complete early repayment of a mortgage loan or cash loan, for the issuance a certificate of outstanding debt, a bank opinion or documents for the establishment of a mortgage. In addition, in 2021, Bank Pekao made it possible to take advantage of the offering of Pekao TFI investment funds without the need to visit a branch. The agreement to provide services of accepting and forwarding orders can be concluded online through the Pekao24 service.

Thanks to the cooperation with Autenti and the solutions provided by this partner, Alior Bank’s clients can open a personal account or take out a cash loan without leaving home.

In addition, Alior Bank implemented remote service for all corporate banking products through:

- broad utilization of qualified signatures, Autenti e-signature and Photo ID,

- launching the option to apply for new transaction products in the BusinessPro online banking service,

- centralization of as much as 45 after-sales processes.

Exchange of bank agreements, annexes, post-sale instructions with a qualified signature, between Alior Bank and entrepreneurs from the SME and large companies segment, can take place via e-mail or BusinessPro electronic banking. Micro-businesses use the e-signature provided by Autenti or the Autenti e-signature in combination with the Foto ID tool for this purpose.

- Development of mobile payments

Alior Bank worked on increasing available functionalities in mobile channels, i.e. foreign payments or payments using BLIK

Bank Pekao was the first bank in Poland to allow clients from the SME and corporate sectors using PekaoBiznes24 e-banking to telephone transfers. From March 2021, they could make a transfer to the phone number of an individual payee, registered in the Polish Payment Standard (PSP) database - in the BLIK system.

- PeoPay KIDS app

PeoPay KIDS is an application aimed at children aged 6-13. In the app the youngest clients of Bank Pekao receive access to Konto Przekorzystne dla młodych (Mega Beneficial Account for the Young), the Mój Skarb (My Sweetie) savings account and the PeoPay KIDS debit card. Thanks to the app, children can learn how to save and manage their money in an easy and accessible manner, and thanks to the payment card they can make cashless payments in stores and withdraw cash from ATMs. The app also includes a coach feature which introduces your child to the world of finance. The PeoPay KIDS app is connected to PeoPay mobile banking and Pekao24 online banking, allowing guardians to view and authorize their child's finances.

Health area

- Artificial intelligence (AI) in diagnostics

The PZU Zdrowie diagnostic imaging network continued its pilot program to diagnose stroke with computed tomography scans. The solution is based on artificial intelligence algorithms and is one of the first in Poland to have found application in commercial operations.

The solution implemented in diagnostic labs supports the radiologist through automatic detection of life-threatening change lesions. The algorithm generates a tentative diagnosis and marks the tests with a special marker. Thanks to that it is possible to nearly instantly undertake the treatment process which reduces the probability of heavy brain damages and increases the patient’s chances of surviving. Thanks to this solution, the time needed to prepare a description whenever a stroke is detected has been reduced from several hours to just a few minutes, which allows patients to be assisted quickly. The AI module has been developed by a Polish startup BrainScan using data from 40 thousand computed tomography tests of the head carried out in the PZU Zdrowie diagnostic network. Then it was tested by radiologists in day-to-day tests to confirm its effectiveness. It has been confirmed that the consistency of the radiologist’s description with the diagnosis of the AI module is approx. 98 percent. The software has a medical certificate and continues to be developed. PZU Zdrowie intends to use it in nearly 40 imaging diagnostic labs.

- Wireless stethoscopes

Innovative AI-based devices make it possible to remotely test the lungs and heart. Following the physician’s instructions, the patient puts the stethoscope to specified spots on the body and the physician remotely receives immediate readout using an online platform. The test does not require direct contact with the patient and increases the safety of physicians and medical personnel, eliminating the risk of infection. At the same time, it provides constant monitoring of the patient’s condition. In 2021, TUW PZUW continued to donate state-of-the-art wireless stethoscopes to hospitals to support them in the fight against COVID-19.

- PZU Zdrowie as a member of the AI in Health Coalition

In May 2021, PZU Zdrowie joined the AI in Health Coalition as a chief member. Within the framework of its activities, the Coalition aims to promote the use of artificial intelligence in the Polish health care system. Bringing together a group of experts and entities pursuing the ultimate objective of the well-being of patients, its ambition is to set directions for the development of the use of AI-based technologies in the sector.

The Coalition aims to develop conditions that will enable the broadest possible use of solutions of this kind. At the same time, it highlights the significance of professional medical personnel, pointing to the supporting role of technology, which is to augment the treatment process rather than eliminate or diminish the role of a physician. In its activities, the Coalition gets involved in projects seeking to advance the digitization of the health care system, in cooperation with the Ministry of Health and the Office of the Prime Minister.

Under the auspices of the Coalition, PZU Zdrowie was a keynote speaker:

- at the AI in Health Conference, presenting the potential of employing artificial intelligence in imaging diagnostics;

- in October, in a hybrid meeting with the Ministry of Health on the e-Health Strategy and access to medical data.

In November 2021, PZU Zdrowie also became a partner of the series of podcasts “Health in Conversation” devoted to the technological revolution in medicine, held by the Coalition in collaboration with the Polish Federation of Hospitals.

1 Fintech - sector of economy encompassing companies operating in the financial and technological industries. Fintech companies most often provide financial services using the Internet. It is also a term for all types of technological or financial innovations. Insurtech is one of the areas of the fintech industry encompassing new technological solutions in insurance.

2 MedTech, HealthTech - segments of the medical technology market which aim at improving prophylactics, diagnostics, treatment, and protecting and improving human health and life.

3 CAPEX and OPEX

Tax strategy

Tax reporting enhances the PZU Group’s transparency, promotes the credibility of entities among investors and other stakeholders and instills trust in Group companies.

Companies belonging to the PZU Group operate in compliance with the prevailing tax law, on the basis of the Tax Group’s Tax Strategy for 2021-2023 and by following the “PZU Group’s Tax Policy” and other internal tax procedures.

Since 2021, the Tax Group has consisted of the following entities:

- PZU;

- PZU Życie;

- PZU Centrum Operacji;

- PZU Pomoc;

- Ogrodowa – Inwestycje;

- PZU Zdrowie;

- Omicron BIS;

- PZU Lab;

- Ipsilon;

- Tulare Investments;

- PZU Cash;

- LINK4;

- PZU Finanse;

- PZU Projekt 01 SA.

PZU is the parent company representing the Tax Group.

The PZU Tax Group accepts only a low level of tax risk in its operations and manages tax risk in accordance with this principle. The activities of the PZU Tax Group aim at eliminating tax risks, in particular through timely payment of tax liabilities and submission of tax returns, as well as fulfillment of other liabilities resulting from the tax regulations, taking into account not only the literal wording of the regulations, but also their purpose.

The PZU Tax Group and its member Companies take necessary measures to avoid situations that could lead to violation of the tax law. The business decisions of the PZU Tax Group and the Companies are made on the basis of assessing the impact of tax risks.

The PZU Tax Group does not intentionally plan or execute transactions of artificial nature, the main or one of the main purposes of which is to achieve a tax benefit. In particular, the PZU Tax Group does not apply solutions that could be regarded as tax avoidance or evasion.

The Companies from the PZU Tax Group are not domiciled in tax havens. Also, the PZU Tax Group does not settle accounts with other entities based in tax havens in order to reduce its tax liabilities in Poland.

The PZU Tax Group carefully analyzes all transactions and the registered offices of its business partners in order to avoid entering into cooperation with business partners who may use solutions aimed at reducing their taxes in Poland.

PZU Group companies do not have tax liabilities - they pay their liabilities by the deadlines designated by the tax laws. The annual tax review and the audit of the financial statements performed by the statutory auditor confirm that these calculations are correct. The competent tax office issues a certificate on not having any overdue taxes in response to requests submitted by PZU Group companies.

PZU Group companies calculate and pay tax liabilities for the following taxes, among others:

- corporate income tax (CIT);

- personal income tax (PIT);

- value-added tax (VAT);

- withholding tax (WHT);

- tax on civil law transactions (PCC);

- tax on certain financial institutions (asset levy) (FIN);

- real estate tax (DN-1.

PZU Group companies participate through the Polish Insurance Association in the process of government legislation and pronounce their opinions during social consultations on bills to change the tax laws.

The PZU Group is one of the top 10 payers of the corporate income tax in Poland,

Corporate income tax by country (PZU Group, Bank Pekao Group, Alior Bank Group)

| (in PLN m) | 2019 | 2020 | ||||

| Profit (loss) before tax | Remitted income tax | Effective tax rate | Profit (loss) before tax | Remitted income tax | Effective tax rate | |

| Poland | 9 372,9 | 2 060,2 | 22,0% | 7 453,6 | 1 817,7 | 24,4% |

| Lithuania | 89,1 | 13,9 | 15,6% | 105,8 | 15,0 | 14,2% |

| Ukraine | 35,8 | 15,4 | 43,1% | 50,7 | 14,5 | 28,6% |

| Latvia* | 58,2 | 0,0 | 0,0% | 70,6 | 0,0 | 0,0% |

| Estonia* | 17,2 | 0,0 | 0,0% | 29,8 | 0,0 | 0,0% |

* according to tax system in Latvia tax is paid on dividend payout, the operations in Estonia are conducted by a Lietuvos Draudimas branch in Lithuania