Equity and bond market

The year 2021 was a period of markets rebounding on the wave of economic recovery and improving prospects associated with the limitation of negative economic effects of the COVID-19 pandemic. The situation was improved by the declining infection numbers and quick progress in the organization of universal vaccination programs. As the restrictions were lifted, the performance of companies improved, supported to a large extent by government aid programs. At the same time, the world’s key central banks maintained interest rates near zero and continued their quantitative easing programs. The central bank of the USA (the FED) did not increase any rates in 2021.

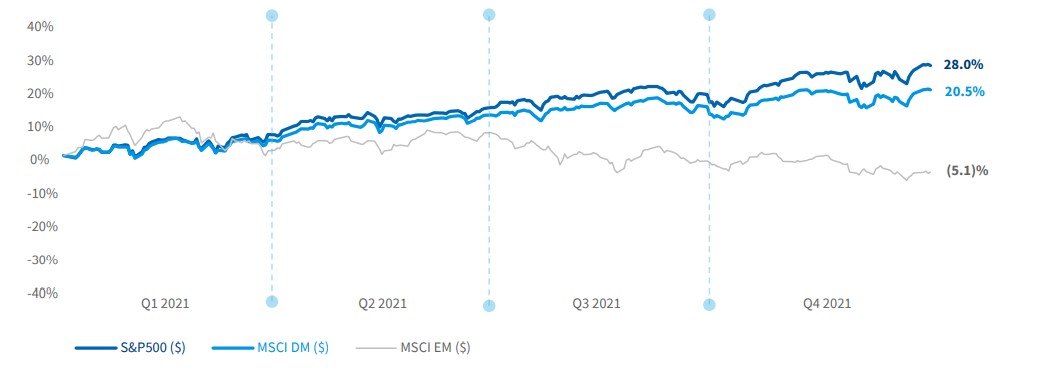

The sentiment on equity markets in 2021 is well reflected by the MSCI AXWI „MSCI ACWI - All Country World Index (in terms of price)” which groups large and mid-cap companies from developed and emerging markets1. In 2021, the index rose 16.8% y/y with a much lower volatility than that observed in 2020, when accumulated weekly losses reached up to 30%.

High returns were recorded both on the US and European markets. Emerging markets proved to be much weaker as they struggled with higher costs of servicing their USD financing and with inflation. Large Chinese technology companies were also depreciating due to additional regulatory burdens.

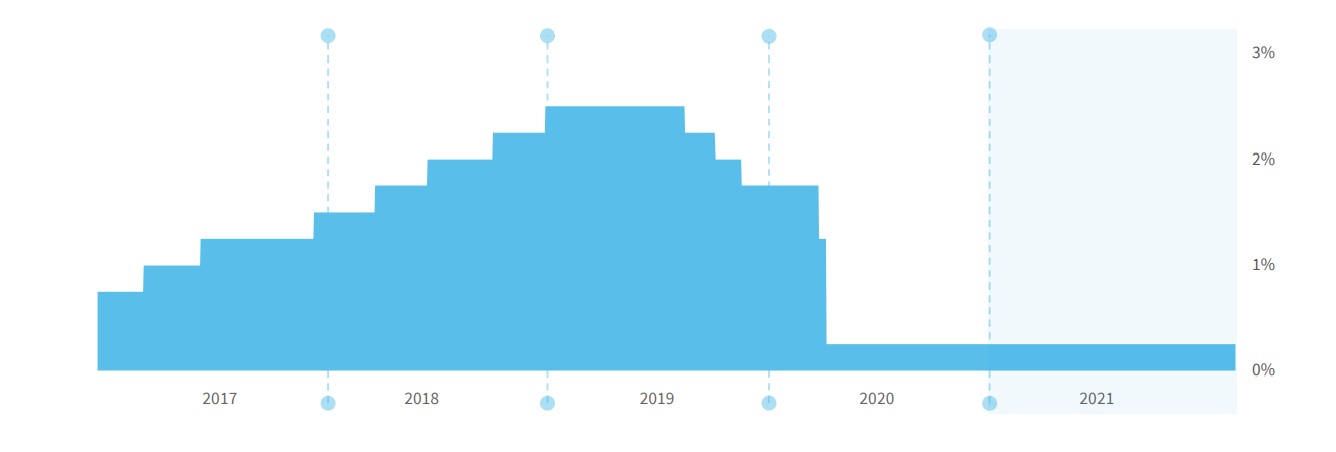

Key interestrate FED (upper limit)

Source: https://fred.stlouisfed.org/

MSCI ACWI ($) 2019-2021

Source: www.msci.com

S&P500, MSCI Development Markets (DM), MSCI Emerging Markets (EM) indices

Source: www.stooq.pl, www.msci.com

In 2021, the main Polish index WIG20 did not go in the same direction as the emerging market index, even though historically they were highly correlated. In contract to the depreciating MSCI EM index, the Polish equity market performed very well in 2021. WIG20 rose 14.3% y/y, driven mainly by the strong growth of companies in the banking sector.

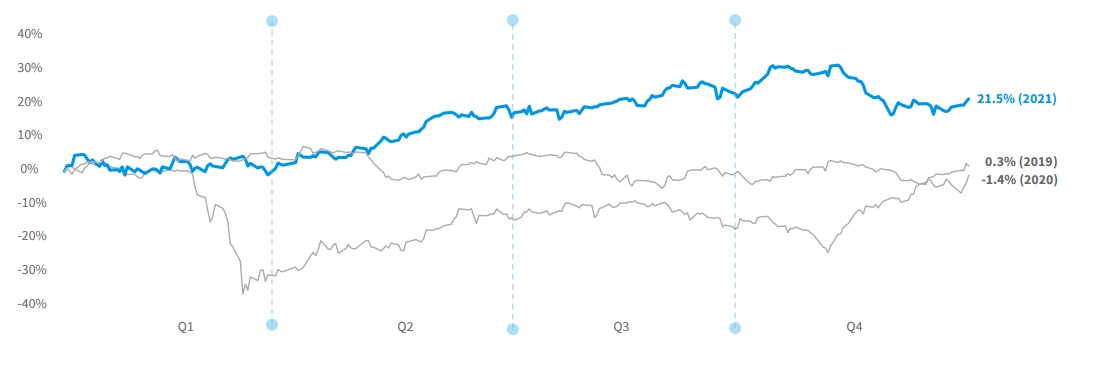

The year 2021 was also a very good period for the wide market WIG index, which rose 21.5% y/y, which is especially impressive when compared to the two preceding years, when returns did not exceed 0.3% y/y. The good performance of this index was visible ever since the beginning of the year and was continued until mid-Q4, when fears about the development of the pandemic returned in connection with the new and more infectious coronavirus variants.

WIG20 vis-a-vis MSCI EM

Source www.infostrefa.com, www.msci.com

WIG (2019-2021)

Source: www.infostrefa.com, www.msci.com

Debt market situation

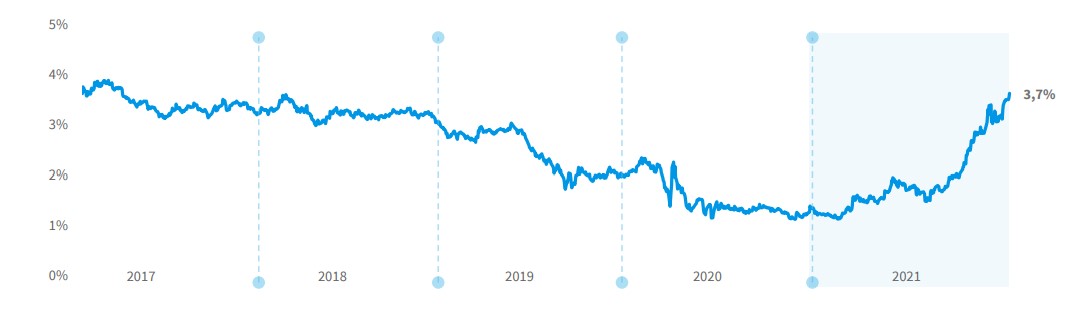

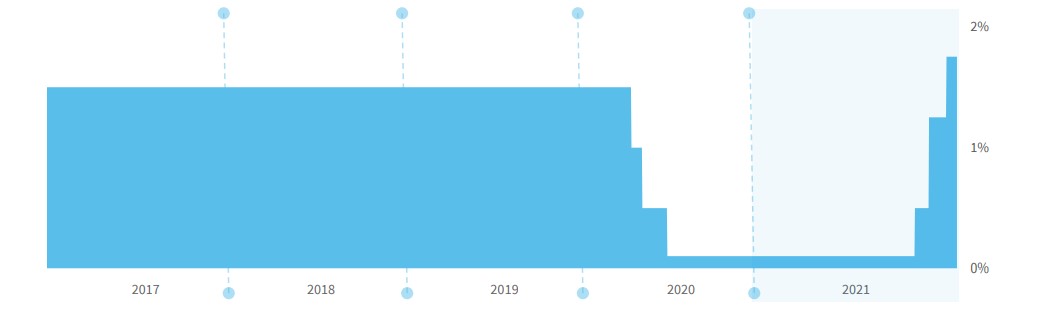

The majority of 2021 was relatively peaceful on the debt market. However in Q4 the situation became more dynamic, in connection with the fast-growing inflation driven by supply factors associated with supply chain interruptions, as well as demand factors due to lockdowns introduced in 2020, or greater demand for electricity. In Q1 2021, the CPI core inflation index in Poland was 2.7% y/y, increasing to 7.7% y/y in Q4 2021. As a result, the Polish central bank (NBP) increased the main interest rate from 0.1% to 1.75% over a period of just two months.

The interest rate increases carried out in a high inflation environment, caused a large decline in prices (increase in profitability) of Polish treasury bonds across the yield curve. 1-year yields increased from 0.05% to 3.47%, 2-year yields from 0.10% to 3.35%, 5-year yields from 0.47% to 3.99% and 10-year yields from 1.25% to 3.70%.

Yields of Polish (10Y) treasury bonds

Source: www.stooq.pl

The situation on the core markets in 2021 contributed to the increased yields on Polish bonds. Yields of 10-year US Treasury bonds, influenced by rising inflation expectations, increased from 0.9% to 1.5%, and of German bonds from -0.58% to -0.18%.

NBP’s main interest rate (2017-2021)

Source: www.nbp.pl

1 At the end of December 2021, the index included stocks from 48 countries, of which of which 23 are classified as developed markets and the remaining 25 are considered emerging markets.